Selling or purchasing commercial or residential real estate such as condominiums, single-family homes, townhouses, or co-ops, is a critical transaction with several legal implications. Due to the increasing intricacy in every form of real estate transaction, you want to have an experienced real estate attorney working to preserve your investment and safeguard your interests. Whether it’s your first time purchasing a property or making a critical business decision, you need a lawyer committed to doing what is in your best interest.

At Arnold Law, we have skilled real estate attorneys who have an in-depth understanding of Florida real estate statutes and work diligently to provide expert legal representation for our clients. We work with clients all over Florida and represent repeat and first-time sellers and buyers. We counsel clients concerning every aspect of real estate transactions, including the decision to sell or purchase, negotiate the applicable terms, resolve unanticipated issues, and conduct the actual title closing.

Real Estate Title and Closing Overview

A real estate title is the right to use and occupy a property. When you buy a property, you’re purchasing the Title to the property. Any entity or person who isn’t party to the real estate transaction can challenge a title to real estate depending on past claims and rights. That is why it is a good idea to pay for a comprehensive/detailed title search and examination before buying a property.

Closing is at times known as Escrow or Settlement. It’s the process whereby the title to a property is transferred from the seller to the buyer. It usually involves completing all the required paperwork to settle the agreement between the buyer and the seller. All financial matters are dealt with during this process. These financial matters are called closing costs. The buyer and the seller sign all the necessary transfer and financial documentation before they’re filed with the relevant local authorities. After which, the title is considered to have successfully been transferred. In simple terms, closing is when and where the money and keys exchange hands, and then the transaction is finalized.

For a typical residential real estate closing, we generally have five participants— the buyer, closing agent, seller, buyer’s agent, seller’s agent. At times, a lender’s representative also attends. Who takes part in commercial real estate closing varies depending on the type of transaction. Because of how commercial transactions are, parties that take part virtually always need to be represented by a lawyer.

Both sellers and buyers depend on their realtors to navigate through the sale or purchase process. And even though they usually go to the closing ceremony with their client, they lawfully can’t answer any questions to do with the documentation presented or language used in those documents. They also can’t advise on the several issues that may arise during the closing ceremony.

Equally, a closing agent can’t give legal opinions or advice regarding closing documentation. The agent prepares the closing documentation, issues the title insurance policy, and presides over the closing ceremony.

When you are using a mortgage to buy real estate, your creditor prepares the closing package, including the deed and closing instructions. But if you’re paying cash, the seller’s lawyer prepares the warranty deed and any other necessary documentation and sends them to the closing agent, who executes it at the closing.

In either case, a non-lawyer, closing agent can’t review the documents, clarify the terms, prepare an addendum, provide a legal opinion concerning the title commitment and abstract, or give any legal recommendations. Only a lawyer is capable of doing these things.

Buying property is a costly decision that could have legal repercussions. Selling property can expose you to legal responsibility. If you don’t fully comprehend the closing documentation and the paperwork you’re signing, there might be serious consequences for the seller and the buyer.

As the seller, there’s a chance that there will be a basis for a suit for breach of contract or misrepresentation if you don’t have sufficient legal representation. Furthermore, you’re still liable for late fees, penalties, and accrued interest if your liens or mortgage aren’t paid off on time after closing the transaction. What if you’re selling just a single lot out of the several lots you have? You will want to ensure you are not selling the wrong lot or more than you intended.

And as a buyer, you may be stuck with inadequate insurance, irregular mortgage terms, or a faulty title. You could be stuck with costly repair bills because of an undeclared addition that wasn’t permitted, easement issues, or undeclared problems with the real estate. Several other matters may arise.

The Role of a Lawyer During Closing

As a seller, you want to ensure you aren’t accused of fraud, misrepresentation, or any other form of misconduct. Equally, you’ll want to ensure the transaction mirrors the negotiated and agreed-upon terms, mainly if you extend seller financing with a loan or there’s any other intricate arrangement.

As the buyer, you’d want the property you think you’re purchasing to be in the state you thought you were buying it in, that is, you don’t want problems or debts of the prior owner attached to the property. Additionally, you’d want to ensure the transaction mirrors the negotiated and agreed-upon terms, mainly if non-traditional forms of financing are involved.

The point is, whether you’re a seller, buyer, lender, investor, or have any other interests in the real estate transaction, you’d want to avoid any legal accusations or to be ripped off. Moreover, the more complicated the closing is the more significant the possible legal responsibility to which you’re exposing yourself.

In a broader perspective, the duty of a closing lawyer, whether in a commercial or residential real estate transaction, is to ensure your interests and legal rights are defended as far as the closing transaction is concerned. They ensure closing instructions are executed in a way agreed upon by the involved parties. Finally, their work is to ensure you do not fall into an unclear legal situation and unnecessarily expose yourself to legal responsibility. Whatever they do in trying to accomplish this job is based on who they’re representing.

A Lawyer as a Real Estate Closing Agent

When an attorney assumes the role of a real estate closing agent, it means he/she is primarily representing the transaction. They’re responsible for ensuring the closing procedure, all the instructions, terms, and conditions of the parties involved are properly observed. The closing lawyer also ensures that the closing moves forward by attempting to resolve any minor dispute and any title issues that could arise, usually at no additional charge. He/she:

Acts as an unbiased settlement agent who performs the actual settlement ceremony obtain all the necessary signatures, arranges for exchange of documents, and makes sure documents are correctly signed and recorded

Obtains approval on documents from all the parties involved, as required

Makes sure the closing goes smoothly by coordinating talks between sellers, lenders, buyers, and realtors

Reviews transaction closing-related documents

Adheres to written, non-conflicting instructions from the seller, lender, and buyer

Arranges for the dispensation of transaction profits per the closing statement

Ensures the seller is entitled to sell the real estate and issue title insurance

Documents Needed for Real Estate Closing

When you go to the real estate closing table, be it as a seller or buyer, there are generally many documents that you, the other side, or both of you have to sign. Each closing differs from the other. However, the documentation for real estate closing in Florida with lender financing generally include:

Promissory Note— a promissory note shows the conditions and terms of the funds the bank lends you, including the amount of loan, interest rate, monthly payments, address to which the money is to be sent, date of the latest payment, and late fees.

Mortgage— this document secures the funds you borrow from a bank. Should you fall behind in repaying your mortgage, the lender is entitled to move for mortgage foreclosure and seize the real estate named in the mortgage as surety for the mortgage loan.

Warranty Deed— warranty deed transfers title from the seller to the buyer. The document legally describes the real estate that’s up for sale. The closing agent records this document in the county’s public records where the real estate is situated to make sure proper public notice of ownership.

Survey— a certified surveyor prepares the survey document. This document shows the real estate’s lawful description, boundary lines, easements, building setbacks, and permanent improvements like a house, a shed, driveway, and pool,

Environmental Site Assessment— based on the kind of real estate being bought, a creditor will need to determine the property’s ecological condition. For instance, has off-site contamination affected the property to be purchased, or are there past leaks from onsite fuel tanks? Clean-up is costly, and the creditor will want to reduce the dangers of these possible clean-up charges. The Environmental Site Assessment document includes reports that could range from monitoring wells and drilling soil borings to assessing public records.

Appraisal— the creditor will need to independently determine the real estate’s worth from a certified real estate appraiser. Based on the kind of real estate that’s being bought, the lender only loans a percentage of the buying price, and the amount of loan is the equity the buyer is required to fund the purchase.

Title insurance policy— title insurance policy is written by the title insurance provider, ensuring that you as the buyer receive marketable and valid title to the real estate and that your lender has a first mortgage or lien payment. A title insurance policy is essential in a closing transaction. This is because it protects you as the real estate buyer and creditor against possible title defects such as past forged deeds, mortgages that are still unpaid of record but were paid off previously, or incorrect past legal descriptions.

HUD-1 or Closing Statement— closing statement refers to a reconciliation of the closing credits, debits, and costs owed to both the buyer and seller. Typical closing charges paid by the seller are the property owner’s title insurance policy, the deed’s documentary stamps, the property commission, and any unpaid mortgages. If you are the buyer, you will generally pay the amount of money the lender is charging and associated mortgage expenses. Rents and property taxes, if any, from tenants are prorated based on the closing. The closing statement indicates the cash seller receives after selling the property and the cash the buyer has to take to the closing table.

Each closing has specific challenges and issues. We recommend that you consult an experienced real estate lawyer to prepare then review the required documentation for you. These are significant financial investments, and you want the best authentic and legal info to spell out what you’re purchasing and the loan terms and conditions. A lawyer will help in ensuring your legal rights are defended both in the present and in the days to come.

Real Estate Title Closing Procedures

Even though real estate lawyers understand the title closing procedure because they’re involved in title closings each day, a layperson like you often experiences confusion regarding everything that happens between the period the sale and purchase agreement is signed up to the closing date. In this section, we explain the title-closing process. We also discuss the fundamental steps involved in each real estate closing transaction, so you have comprehensive knowledge of the several actions real estate lawyers take to close a property transaction successfully.

Submitting the Title Order

Once you as the purchaser and the seller sign a sale and purchase contract, and you make the first escrow deposit, your lender (in case of a financed transaction) or realtor (in case of cash transaction) submits the title request form to your closing lawyer to kick off the process.

Generally, your lender or realtor completes and sends a two- or one-page request form to your lawyer, containing all the relevant info associated with the transaction, like property description, party names, lender information, existing mortgages, and purchase price. Many real estate lawyers also have these kinds of forms on their respective websites where your lender or realtor can electronically fill in and submit the title request form. Your realtor also sends your lawyer a copy of the signed sale and purchase agreement at this stage.

File Processing

Processing the real estate transaction kicks off immediately after your closing lawyer receives the title form. Several third parties must be involved for the necessary documentation and information to be acquired early enough for the title closing date. For this reason, a skilled lawyer will start processing the transaction soon after receiving the title request form.

This step includes ordering:

Loan payoff statements,

Tax info showing the status of prior and current years’ taxes,

Condominium or homeowner association estoppel letters that show maintenance fee and any other assessments,

Surveys,

Certificates showing hazard insurance, and

Inspection reports.

Additionally, at this point, your lawyer requests the judgment and lien search report from the lien search company and the title search report from the title insurance guarantor.

Title Search

At this stage, a comprehensive search is conducted. The search takes place at the office of public records in the county where the property is situated. Records searched include mortgages, deeds, judgments, lis pendens, restrictive covenants, easements, divorce settlements, title liens, and other documents brought to the office of public records, which impact the title real estate.

After locating all the documents, the title insurance guarantor compiles a report for the title search, which comprises all these documents then gives it to your closing lawyer.

Title Examination

Once the closing lawyer receives the report of the title search, a title examination starts. The closing lawyer first issues you, and if necessary, your lender with a title commitment depending on the information in the title search report. After that, the lawyer examines all the documents discovered during the title search, which impact the title to the real estate to establish the present title status and whether there are title clouds that must be cleared before closing. The lawyer will also verify the legal property owner’s record and note any outstanding debts against the real estate.

Document Preparation

Once any existing title cloud is addressed and you, the seller, and any other involved party are ready to close the real estate transaction, the closing lawyer prepares all the documentation required to close. These documents include the bill of sale, deed, Foreign Investment in Real Property Tax Act (FIRPTA) certificate, closing statements, and affidavits.

Related to this, if you are financing the property purchase, your lender will send their closing instructions to the closing lawyer so that he/she includes all the lender’s fees, escrows, and charges on the closing statement.

An expert closing lawyer distributes samples of all the closing documentation to the interested persons before closing so they can review, comment on, or revise them, if need be, and ultimately approve them before closing.

Transaction Closing/Settlement

After all the closing documentation is approved, the time and date for transaction closing are scheduled. At the closing table, the lawyer oversees all the sale and purchase transaction closing aspects and answers all the questions that may arise relating to the closing documentation or transaction in general.

As the buyer, you will sign the buyer’s documentation and loan documents (in case of a financed transaction), while the seller will sign the warrant deed and other seller documentation. Afterward, you and the seller will both sign the HUD-1 settlement statement.

At this stage, the seller and buyer may enter into a tax reproration agreement to take care of the possibility that the real estate taxes are less or greater than the money collected during closing.

Once the transaction has been closed, the seller, realtors, lawyers, and any other party to the transaction receive payment. Specific documents are then sent for recording in the county where the real estate is situated.

What Next Once the Buyer Leaves the Closing Table?

After the transaction is finalized and the money is disbursed, the closing agent sends the Mortgage and Deed to the county recording office where the property is situated, where they will be included in the official records. After the closing agent receives the Mortgage and Deed recording info, he/she issues the title insurance policy. The recording information comprises the official record book number and page where the documents will have been recorded.

Title insurance policies are usually given to the property owner and their loan lender. After the property owner receives his/her recorded title insurance policy or deed, he/she should ensure no other item is added to his/her title insurance policy. This means he/she has to review his/her title insurance commitment then compare these two documents. There shouldn’t be any exception on the title insurance policy that wasn’t included in the title insurance commitment. After all these steps are done, that’s when the title closing ends.

Closing on real estate takes thirty to forty-five days when your loan starts processing and one hour or more on the day you sign the final paperwork.

How Title Insurance Works

if someone files a claim against your property, title insurance, per the terms of your insurance policy, assures you of a legal defense and pays all court charges and related fees. Additionally, if the claim is valid, you’ll be reimbursed for your actual loss up to the face amount of the title insurance policy.

The cost of title insurance varies depending on the buying cost of the real estate. A title insurance premium is paid once only during closing. In Florida State, a title insurance premium is based on promulgated rates and calculated depending on the buying price.

Who pays for title insurance varies depending on what the seller and buyer negotiate, the contract used, and the property’s location. Generally, the seller pays for title insurance and selects the closing/title company. But in Broward and Miami-Dade counties, the purchaser pays for the title insurance and chooses the closing/title company.

Find an Experienced Real Estate Lawyer Near Me

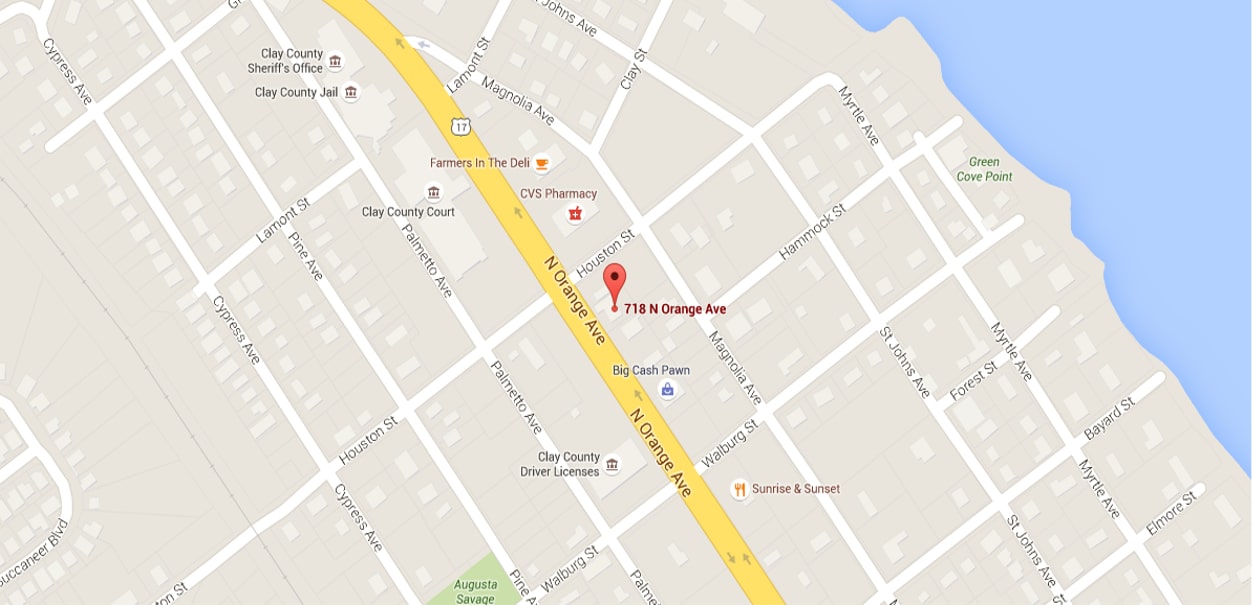

At Arnold Law, we have been offering real estate closings services in Florida for several years. Our closing experience includes preparing and reviewing all the necessary closing documents, conducting lien searches, initiating and conducting title searches, resolving title-related issues, and performing and representing all our clients at the closing table. Our degree of passion for real estate closing is unmatched in the industry since we are good at establishing a close working relationship with each client so that we’re capable of representing their interests effectively. Do you want to sell or buy a property? Please contact us today at 904-264-3627, and we will help you out.