Understanding Florida estate planning without comprehending the defined legal terms is like designing and building your home without understanding the basic construction terms. When you understand the terms, you will know the different documents, their specific purpose, and how they work. Therefore, we will lay out in this article estate planning terms in simple language, to help you understand all the elements of estate planning and help you make informed decisions.

Defining Key Estate Planning Legal Phrases and Terms

AB Trust— It is two trusts used together to reduce estate taxes. Also known as "marital trust," "QTIP," "marital deduction trust," the "A Trust" holds an amount which the deceased partner's exemption can't shelter from tax. On the other hand, "B Trust," "Bypass Trust," or "Credit Shelter Trust" holds the amount the deceased spouse's exemption could shelter. The trust allows one partner to offer care of their surviving spouse while preserving death tax exemptions and providing shelter from the living spouse's future spouse and creditors.

Administration— When personal representatives collect the deceased's assets, pay claims, and distribute the rest of this estate under the Law of Descent and Distribution or the will.

Applicable Exclusion Amount— Amount of asset a deceased owns exempt from your federal gift and estate tax.

Assignment— It happens when you transfer or assign part of or all your interest in the estate to another person.

Attorney-In-Fact— This is an individual approved to act for somebody else, to perform official transactions like a business. Usually, the individual presented designates a person as their attorney-in-fact by assigning power of attorney. The attorney-in-fact does have to be a lawyer or a person with outstanding qualifications. It can be your friend or family member.

Beneficiary— A beneficiary is named in your will and has potential rights or rights to acquire wealth transferred through the will.

By-pass trust— It is tailored to save money on estate taxes. Every person obtains a specific amount of money, which is exempt from estate tax. It was five million four hundred and fifty thousand dollars as in 2016. Trust eliminates one situation. Let's assume a married couple plans to leave their money to each other in their will and the rest of their children. If the wife dies first, all her money will go to her husband tax-free because he is her surviving spouse. Nevertheless, when she dies, he only has five million four hundred and fifty thousand dollars exemption, and the remaining amount passed to the children is subject to estate tax.

Mental capacity— refers to the ability to create a lawfully valid will or estate planning documents like a power of attorney and make reasonable changes to existing estate plans.

Charitable Remainder Annuity Trust— While the trust is created during the settlor's lifetime, it becomes effective after the settler's death. It's an irrevocable trust that benefits the settlor, their family, and ultimately a charity of the maker of the CRT's choice.

Charitable Remainder Trust— This is a tax-exempt trust tailored to reduce the taxable income of persons by initially dispersing income to the trust's beneficiaries for a given time and later donating the rest of the trust to a designated charity.

Charitable Remainder Unitrust—Refers to a tool that offers income to the beneficiary during the grantor's lifetime and the remainder of your trust to a charity. Usually, the donor or the donor's family members are the initial beneficiaries. The trust gives variable income to beneficiaries founded on the percentage of the trust's fair market value.

Conservatorship— This is the legal relationship where the court appoints a person to manage an absentee's estate. Any person with interest in the estate or property of the absentee or the absentee dependent can file a petition for conservatorship. It could be a parent, sibling, spouse, or child.

Designated beneficiary— This is a beneficiary who inherits property like the balance of the individual retirement account or life insurance policy after the property owner's demise.

Designated Beneficiary Trust— Refers to a designed trust which qualifies its beneficiaries for selected beneficiary status.

Power of attorney— The document delegates authority from one individual to another, for the latter to act on the former's behalf regarding matters apart from health care. The document maker might make it broad or restrict it to specific acts outlined in the document. A limited power of attorney gives your agent consent to engage in particular conduct. A general power of attorney gives your agent permission to engage in any lawful conduct for you, only to restrictions outlined explicitly in the legal document. General and limited powers of attorney are no longer useful when and if the principal is incapacitated. Since most people desire a power of attorney that might continue to be effective upon his/her incapacity, the law offers durable power of attorney. The legal tool is still useful even when its maker is incapacitated.

Estate— The term refers to all the deceased's property whether they go through probate or not.

Equitable Title—Refers to an individual's entitlement to receive full ownership of assets or property interest. It is the benefits you get to enjoy, consume, or use an asset once you become the lawful owner.

Estate planning— Planning to ensure your wishes are complied with following your demise, that a person you trust can manage things on your behalf should you become incapacitated, and your family is spared unnecessary delay and expenses. Some of the estate planning documents include a will, living will, and power of attorney.

Estate tax— Refers to the state and federal government's tax on transferring assets from the deceased person to their beneficiaries or heirs. The tax is measured and levied on by the estate's size.

Executrix (female)/executor (male)—A person tasked with managing the deceased person's probate estate affairs. They ensure the decedent's liabilities and debts are paid from the property and assets left behind and later transfer what remains to the beneficiaries. The decedent names their executor/executrix, and the judge will appoint the person unless beneficiaries object. If there isn't will or the will is silent, the judge will set a family member.

Family Trust— The trust is created to benefit your family members, such as your children and spouse.

Fiduciary—A corporation or person entrusted to act in the principal's best interests. It can be a guardian, conservator, executor, administrator, or trustee.

Fractional interest— This legal term means less than one hundred percent share of possession held by an asset's joint owner.

Funding A Trust— Refers to the process of transferring your property from you to your trust. To achieve this, you should physically change your property's title from your name to your trust's name. Once the ownership is transferred, the trustee will have control of the assets.

Generation-Skipping Transfer (GST) Tax—GSTT is a tax that leads to a transfer of property by inheritance or gift to an heir who is more than 371/2 years younger than the donor. It ensures that taxes are paid when the property is placed in a trust, and beneficiaries receive amounts that exceed the generation-skipping estate tax credit.

Gift Tax—There isn't a Florida gift tax, but the federal government enforces one. It is the tax on transfers of money or property to other people while getting nothing (or less than full value) in return. Few people owe gift tax; the IRS generally isn't involved unless a gift exceeds fifteen thousand dollars.

Grantor—Commonly referred to as "settlor" or "trustor," a grantor is the individual who creates a trust.

Guardianships—It is used when a person is incapacitated because of physical or mental infirmity that they can no longer make decisions. The court appoints the power where a predetermined individual hasn't been given the ward's powers (the person being taken care of). While family members are the usual guardians, the court can select professional organizations.

Gross estate— Refers to the value of all who have ownership interest during death. It is tailored for your estate tax needs.

Heir—A person lawfully entitled to inherit all or some of the estate of a person who died interstate. That means the decedent did not establish a lawful last will and testament when alive.

Inheritance Tax— It is the tax on property inherited from a deceased person. It is calculated based on the individual asset you received from the estate. While beneficiaries are accountable for paying the tax, a will sometimes offers the estate should pay.

Irrevocable Life Insurance Trust— It is tailored to own and control a permanent life insurance policy or term when the insured is alive and manage and distribute the proceeds paid out upon the insured's demise.

Intervivos—This is the other name for a living trust. It is used by attorneys who cannot give up Latin. It is a trust you create when you are alive instead of after your demise under your will's terms. It becomes effective immediately when you sign it.

Inventory—All assets included in the probate estates in the formal probate administration and the estimated fair market value during the deceased person's death for every property. It helps beneficiaries and heirs know what is in the probate estate, promoting transparency for the personal representative's responsibilities in the probate process between the interested persons and personal representative in your estate.

Joint ownership— It refers to the arrangement where at least one partner shares the title to a property.

Joint tenancy— These are assets owned in joint tenancy automatically passes to a surviving owner once one owner dies. Probate is not required. Often joint tenancy is effective when couples obtain motor vehicles, real estate, bank accounts, among other precious assets. Each joint tenant should have an equal share.

Law of Descent and Distribution is the statute which determines how assets of an individual who dies without a will are distributed to heirs.

Life Estate Deed— Commonly referred to as Transfer on Death Deed or Beneficiary Deed, a life estate deed permits the automatic transfer of property to remaindermen after your demise. It creates a life tenant during your lifetime. Some of the benefits of this arrangement include avoiding probate, offering peace of mind, saving legal charges, tax savings, and keeping your homestead exemption.

Legal Title— The individuals whose names are on a signature card, deed, or registration certificate. Registered ownership of property.

Marital Deduction—A provision in the Federal Estate and Gift Tax law permitting a person to transfer an unlimited amount of property to their spouse at any time, including at the transferor's death. It is an estate preservation tool since property could be distributed to the surviving spouse without incurring gift or estate tax liabilities.

Marital Trust— Refers to a tax-deferred trust that is eligible for the federal estate tax marital deduction. As per 2016, a family or credit shelter trust could cover the initial five million four hundred and fifty thousand dollars of an estate for tax. The rest could be tax-deferred under marital trust. After the benefitted partner dies, assets in the marital trust are subject to tax. However, using this tool allows your partner to enjoy the marital trust's monetary benefit during their lifetime.

Separate Writing—A written list or statement referred to in the deceased person's will shall dispose of items used in business or tangible personal property. In other words, it is the list of things the testator owns and the persons who will receive them, which is referred to in the will and is kept with the will. It could avoid conflict during probate when beneficiaries argue over who gets a valuable asset.

Personal property— A tangible personal property is a physical asset that can be picked or moved, including household decorations, artwork, pictures, and collectible. On the other hand, intangible personal property may include land, investments, and money.

Personal Representative— Refers to a person appointed to administer the deceased person's estate. If a will doesn't elect a personal representative or a decedent's selected personal representative is unwilling to serve, the probate court appoints the personal representative. Under the law, the factors the court uses don't include the person's designation as a beneficiary of the will.

Pour-Over Will— Most seasoned estate planning attorneys use a Pour-Over Will to compliment irrevocable or living trust. It transfers all your probate assets into a trust when you die. Then the assets are distributed to the trust beneficiaries according to the terms. After the transfer is complete, the trust's trustee will oversee administering your property and, as instructed by the trust document, on how to distribute the assets.

Probate— Process of sharing assets in the will or under the laws if there isn't a valid will. Because it is a court-supervised process, the testatrix and their heir should depend on a fair and full distribution and administration of an estate. While all assets don't have to go through probate, an analysis of every estate is necessary.

Present Interest—To qualify for an annual eleven thousand dollars from the Federal Gift Tax, the gift should be a present interest. The donee should own the gift without strings attached.

Qualified Domestic Trust (QDOT) —Refers to the special trust that allows taxpayers who survive a deceased partner to take a marital deduction on estate taxes. Typically, a United States surviving partner could take the marital deductions while a non-citizen can't.

Qualified Personal Residence Trust (QPRT) —Refers to the type of irrevocable trust that permits you as the creator to remove a personal home from your estate to reduce the gift tax amount incurred when transferring property to a beneficiary. It allows you to continue living on your property for time with a retained interest in your home. After the period elapses, the remaining interest is transferred to your beneficiaries.

Real Property— Refers to land, fixtures, buildings, and any improvements to the land.

Retirement Accounts—An account, plan, or funds established to offer you retirement benefits. It is created under federal law and is subject to income tax upon withdrawal. Common types of retirement accounts include pension and profit-sharing plan and IRAs. After your death, your retirement plan administrator will contact your designated beneficiaries and ask them how they want to receive the retirement account funds.

Revocable Living Trust—Refers to trust, which becomes effective after its formation while its trustor is alive and can be amended and revoked during the trustor's lifetime. It facilitates tax planning, addresses family issues, avoids probate, and provides for your estate distribution. You should consider a revocable living trust if you own real estate, have money either in investment portfolios or banks, have grandchildren or children, have a business, and are married but did not create or modify an estate plan since the wedding.

Revocable Trust— Refers to the document you create to manage your asset while alive and distribute the remaining property following your demise.

Settlor— The person who sets up the trust and names the beneficiaries and trustees.

Supplemental Needs Trust/Special Needs Trust—Means a trust that does not interfere with essential government benefits like Medical and Supplemental Security Income. Generally, it has provisions to protect a person living with a disability and allow them to have property held by a trustee who can supplement specific government benefits in a particular manner.

Spendthrift Trust—Under Section 736.0103 of the Florida Statutes, a spendthrift trust stops creditors of a beneficiary from accessing a property in your trust before the assets are distributed to the beneficiary. Creating the spendthrift trust protects the beneficiary and grantor from selling or wasting assets. The process of establishing a spendthrift trust doesn't differ from the process of creating any other trust. The only variation is that the spendthrift trust should have a spendthrift provision that describes how the trustee will control the beneficiary's access to the property in the trust.

Substitute Trustee/Successor Trustee—A person who takes charge following the resignation, disability, or death of the previous trustee.

Tenancy-by-the-Entirety—Form of property ownership defined as jointly owned marital assets with survivorship rights. Survivorship rights mean that when any co-owner passes on, the joint property's legal title automatically passes to the surviving owner.

Testamentary Trust—Under Florida Statute 736.1106, a will which becomes effective when the settler dies creates the testamentary trust. The settler gives the direction for establishing their trust during the creation of the will. Although the will exists after its execution, the trust isn't created until the settlor's death, and the estate has passed through probate.

Testatrix(female)/Testator(male)—The individual who signs the will.

Trust— Refers to the arrangement that permits a trustee or third party to hold assets on beneficiaries' behalf. Trusts could be arranged in different ways and outline when and how assets are transferred to the beneficiaries. Because a trust avoids probate, the beneficiaries access assets faster compared to using a will.

Trustee— An organization or person who manages and distributes trust property under the terms outlined in a Declaration of Trust. The grantor appoints the trustee.

Trust Estate—Property transferred to a trustee by registering his/her legal name as the trust’s trustee again. Trust estate could be bank accounts, brokerage accounts, stock, partnership interests, real estate, and bonds.

Unified Credit— This means the amount all persons are allowed to deduct from federal estate taxes owed after death. In 2012, the credit was one million seven hundred and seventy-two thousand and eight hundred dollars. It's the amount of estate taxes that would be due on $5,120,000 in net assets. After applying for this credit, the result is that five million one hundred and twenty thousand dollars is "exempt" from estate taxes in 2012.

Will—Refers to the written direction regulating the disposition of the asset at death. You should be above eighteen years as the testator and of sound mind when you sign the will. The will should be written and witnessed, and notarized under the law.

Find a Skilled Estate Planning Attorney Near Me

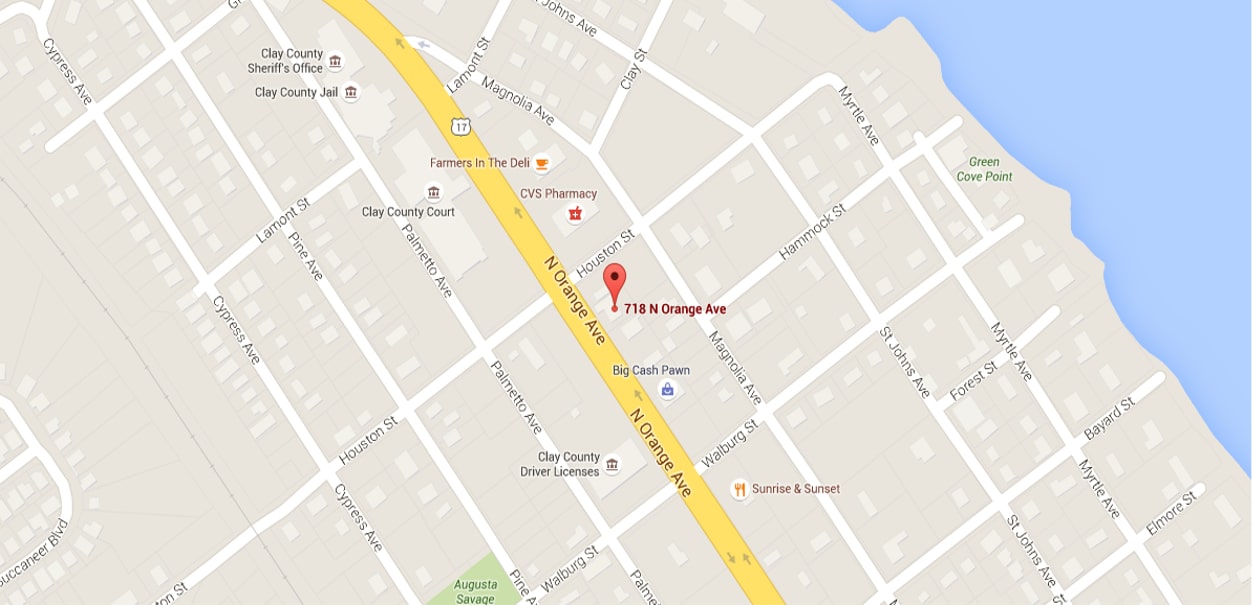

When considering probate litigation regarding your trust, estate, or will, you might encounter numerous legal concepts and terms unfamiliar to the public. The above list is just a fraction of what you might hear. As a result, you should engage a seasoned attorney. Call Arnold Law now at 904-264-3627 to talk to our probate litigation attorneys. We will be glad to answer your questions and address your concerns.