In Florida, estate planning is a process that involves the drafting of documents that direct how a person’s property will be handled in case of death or incapacitation. This plan protects an incapacitated partner and allows the other spouse or partner to make health-related and end-of-life decisions. Some of the common decisions that will need to be made after death include the issues of burial or cremation and transfer of assets following the law and as per the loved ones’ intent.

Although same-sex couples have the same estate planning needs as opposite-sex couples in Florida, there still exists a high level of discrimination and inequality in the legal system. If you are a member of the LGBTQ community and seek to make an asset protection plan for you and your partner, you will need expert legal guidance. At Arnold Law, we understand the challenges that gay men, lesbians, and bisexual individuals of all marital statuses face. We use a high level of knowledge and experience in estate planning law to protect your rights, partner, and children. We serve clients seeking legal guidance to plan their estate in Florida.

Overview of Estate Planning for Same-Sex Couples

While lesbian and gay couples who choose to marry in Florida are accorded the same protection as other married couples, LGBTQ individuals still face a unique set of challenges during estate planning. Regardless of the significant legal advances, there is still discrimination and inequality toward these individuals. In Florida, estate planning for same-sex couples is customizing the estate planning documents and processes to fit the unique needs of the LGBTQ individuals, their partners, and their families.

Estate planning allows you to have clear directions of how your property and decisions surrounding your personal and financial life will be handled in case of incapacitation or death. While estate planning is easier for married couples, you should be able to protect your partner regardless of your decision not to marry. Same-sex couples have the same financial and estate planning needs as opposite-sex couples, whose main goal is to protect their loved ones. However, as a member of the LBBTQ, your problems may begin with the difficulty in legalizing your marriage.

Before legalizing same-sex marriages in Florida, same-sex partners were not entitled to intestate and tax benefits to heterosexual couples. With the increased acceptance and legalization of these relationships, same-sex spouses are entitled to many benefits.

If there is no will at your passing, your spouse may be entitled to half of your entire probate estate. These legal realities often create new considerations during the estate planning process. Some of the factors you should have in mind when making estate planning decisions include:

- The structuring of your assets.

- Whether or not your estate plan provides enough for your partner, you wish to include other family members in your will.

- Whether or not you need to explore trusts or other options.

Although the state of Florida recognizes unions between same-sex couples, you may need the guidance of an attorney to help you protect your rights and that of your partner during the estate planning process.

Important Documents for Same-Sex Couples Estate Planning

A verbal order or wish may not be enough for same-sex couples to protect your partner if you are incapacitated or deceased. Since the issue of same-sex relationships is not entirely addressed in the law, your partner could suffer disinheritance and other inconveniences following your death. Therefore, you may require the following documents to ensure that your estate plan is effective:

Power of Attorney

A power of attorney is the legal authorization that gives a particular person the power to act for another person. The person given a power of attorney is known as the agent, and they may have a broad or limited authority to make decisions for the principal. Like with relationships between straight individuals, a power of attorney is an important tool for same-sex couples who are in the process of estate planning.

Often, a power of attorney s used in the event where the principal is permanently or temporarily incapacitated or when they are incapable of presenting the document. A power of attorney is not permanent, and it can end when the principal seeks to revoke it, they die, or the court invalidates it. If you and your partner are married, a power of attorney may become invalid following a divorce.

A power of attorney for use in case of need may be a consideration if you plan for long-term care or incapacitation. The POA may address the desired actions on assets or health care decisions. If you are in a same-sex relationship, you must have health care and financial power of attorney. Failure to do this could result if the property of one partner is out of reach for the other in case of incapacitation.

There are several types of power of attorney that you can explore as you plan your estate in Florida, including:

- General power of attorney. As per its name, this type of power of attorney gives the agent the authority to decide on the principal’s financial and legal matters. However, the specific matters they can control must be specifically indicated in the document.

- Limited Powers. With the limited power of attorney, the agent can only act on specific matters for the principal. The specific action that the agent is entitled to often may be indicated. In most cases, the limited power of attorney is in effect for a short time.

- Financial POA. Financial matters are a common form of dispute when a person is incapacitated. Therefore, the financial power of attorney is common. This document will allow the agent to make decisions and manage the principal’s financial affairs. Some of the common actions that a person can perform while holding the financial power of attorney for another person include depositing security checks, filing ten taxes, and signing checks. In this case, the agent must carry out the activities within their power scope and to the principal’s best wishes.

- Durable POA. The durable power of attorney spells out the specific financial or legal issues an agent can control. Even when the principal is mentally incapacitated, the agent cannot act beyond what is stipulated in this type of POA.

- Healthcare POA. This is a power of attorney that each person in a same-sex couple needs to have as part of their estate plan. The medical POA authorizes the agent to make critical healthcare decisions for the principal. If you fail to have this document and are incapacitated, the discriminative laws could surpass your partner and put you under the care of other family members.

While some regimes accept an oral POA, verbal instructions may not be a reliable substitute for the written document. Therefore, writing your power of attorney will help protect your partner from unnecessary legal battles with other people who want to control your assets or make crucial decisions about your life in case of an emergency. Any time a person wants to make a health or financial decision about another person, they will be required to produce a power of attorney.

Last Will

In Florida, a Last Will is the formal document that directs the disposition of your property after your death. This document helps choose a guardian for your children when there is no surviving biological or adoptive parent. Often, a will is administered through a legal proceeding known as probate. Probate is designed to ensure that the decedent’s creditors are paid before transferring the remaining property to the heirs.

If you are in a same-sex relationship, writing a will ensures that your partner receives the necessary protection regarding your property. You can write your will during your lifetime, and your representative ensures that the wishes you have stipulated are followed. Additionally, the representative will have a right to bring or defend a legal claim brought by third parties against the probate estate.

When choosing a representative for your will, you can appoint a spouse, child, or parent as long as they live in Florida. A will could be simple or complex depending on the type of property you have and how you want to divide it. Most simple will make your spouse the sole beneficiary of your estate and the remainder to the children.

When establishing a proper estate plan in Florida, your will must meet the following criteria:

- A will must be in writing. An oral will and testament are not acceptable in Florida. Therefore, your will must either be typed or handwritten.

- Must be signed by a tester. Tester is the legal name used for a person making their last will. If you fail to sign your will, your partner cannot use it to claim a share of your property legally. Additionally, the will should be signed in the presence of two witnesses.

If you die without a last will, the state will be responsible for dictating how your property will be divided among your spouse, children, and partner in the case of same-sex couples.

Living Will

A living will is a legal document that allows you to state your wishes for end-of-life medical care. Despite its name, the living will is not similar to the last will used to divide assets and property after a person’s death. Your medical wishes can be known and fulfilled with a living trust when you cannot communicate them. If you are in a same-sex relationship and are planning your estate, you should not assume that your partner will have the sole authority to decide your end-of-life fate.

You need always to have a living trust in your estate plan to provide healthcare professionals and family members with the right guidance. While you can prepare a living will by creating a simple document and attaching other estate planning documents, it would be best to have the insight of a probate and estate attorney throughout the estate planning process.

Florida laws allow you to spreads your wishes with as little information as possible. A living will is valid if it meets the specific notarization requirements of the state and can be revoked. As soon as you sign your living will, it goes into effect anytime you cannot communicate your wishes.

Sometimes, the living will is used together with the durable power of attorney for healthcare, where you appoint a person to communicate your wishes regarding medical care in case of incapacitation. The main difference between a living will and the last will is that the last will is executed after a person’s death. On the other hand, the authority in a living will is not long-lasting, and the document becomes invalid following the death of the person who made it.

Revocable Living Trust

If you put assets in a living trust, you must pay the same tax as if the assets were bringing you income. Putting assets in a living trust is that they change their title and status for legal purposes. Instead of this asset being under your name, it will be under the trust. It would be best always to have a trustee for your living trust. You will be the trustee during your lifetime unless you designate another person. Following your incapacitation or death, the person you appointed as a trustee will follow your wishes for the specific assets.

If a revocable living trustee fails to follow your wishes after your death, they will be liable to your beneficiaries for breaching their duty. If you are in a same-sex relationship, having a living trust could help in the following ways:

- Avoid probate court. The first significant purpose of a living trust is to avoid probate court. Often, all assets under your name that do not have a beneficiary must pass through probate court. When you transfer the asset to the trust, it will no longer be in your name, and you can avoid probate. For many LGBTQ couples, keeping financial affairs private is very important.

- Avoid guardianship court. Another purpose of a living trust is to avoid guardianship court. If you are incapacitated and need assistance to carry out daily activities, a guardian must be appointed to take care of you. Depending on their authorized decisions, a guardian can either be of your property or your health. A living trust helps you avoid guardianship court since you will have designated a trusted successor.

- Asset protection for your beneficiaries. Contrary to what many people believe, a revocable living trust will not protect your assets during your lifetime. However, upon your passing, the successor can make the necessary distributions as stipulated. In many cases, a lack of trust could deny your partner a right to receive anything from the trust since the law could favor other family members over them.

- You control your assets at death. You can change your trust during your lifetime as you see fit. However, after your death, the trust becomes irrevocable. For this reason, the last wishes you had will be indicated in the trust and will be followed. Since not all people in your life may accept your same-sex partner, a trust will protect them from discrimination during the distribution of your property.

- Protection of individuals with special needs. If you want to provide for someone receiving Medicaid or other government benefits with your inheritance, then setting up a revocable trust would be the best way to go about it. Otherwise, any inheritance you leave to them could be used to discredit their need for continued government aid.

Designation of Healthcare Surrogate

A designation of healthcare surrogate is a document that allows you to appoint a person to be inch are of your healthcare decisions following incapacitation. If you are in good health, your decision on your healthcare is final. However, your agent could still obtain crucial medical information from healthcare personnel and hospitals on your behalf. Drafting a designation of healthcare surrogate allows you to choose the person you are comfortable with carrying out your wishes.

Whether you are in an opposite-sex or same-sex relationship, your partner might be the person that knows you best and who can carry out your wishes. However, dues to the discrimination that still exists against members of the LGBTQ, your partner may not be allowed to make any decisions following your death. However, having a designation of healthcare surrogate and probably naming them as the surrogate can help avoid any inconveniences caused by your family members.

Estate Planning Techniques for Same-Sex Couples

With the inability to be recognized as ‘married’ in Florida, same-sex couples face many challenges and inconveniences in the estate planning law. However, you may be able to explore the following options to ensure that your assets are easily transferred to your partner with minimal impact on federal transfer taxes:

Basic Planning Technique

Basic planning techniques include gifting and utilization of the AEA and the annual exclusion for federal gifting. The gifted amount will escape the federal estate and gift taxation through annual gift exclusions. For this reason, you can transfer a significant amount to your partner while escaping gift taxation. Utilizing the AEA increases the gifting power. However, the main disadvantage of this technique is that the partner who receives the gifts will ah e ownership of the assets even when the relationship ends.

Another technique for basic estate planning involves tilting property to fit the JTWROS. A same-sex partner effects a taxable gift of up to one and a half of the gifted property following complete gifting with no marital deductions. The most significant benefit of this technique is that the gifted property will be automatically transferred to the surviving partner.

Intermediate Planning Techniques

With the basic planning techniques, the richer partner will transfer the dorm of their property to the poorer one while relinquishing control of the transferred property. In such a case, the richer partner will not be able to gain back their property. On the other hand, immediate planning techniques allow for gifting with the exclusion of an amount that can be transferred from one partner to another.

You can transfer the property you wish to gift your partner into a trust which leaves you in ultimate control over the property. Putting gifts in trust helps protect you if the relationship ends and you wish to have the assets back.

Advanced Planning Techniques

In addition to the concept of a gift trust, you can explore more advanced techniques that allow you to leverage transfer tax exemptions when transferring your assets to a trust. One of the most common and acceptable techniques for same-sex couples is where the guarantor retains the income in the trust. Before 1990, individuals could transfer assets to their next generations while retaining property use in the present.

In case of the settler’s death, the property in the GRIT would be returned to their estate or used to settle taxes. Congress enacted a law that provides that the retained interest will be zero for all property transferred into a trust for a loved one’s benefit.

Find a Skilled Estate Planning Attorney near Me

A comprehensive estate plan allows same-sex couples to provide for each other’s needs regardless of marriage. Although lesbian and gay couples choosing to marry in Florida are accorded the same legal protections as all married couples, LGBTQ individuals face various planning challenges. The concerns and goals of estate planning are lifetime protection and a smooth transition and passage of assets with the least effort and expense.

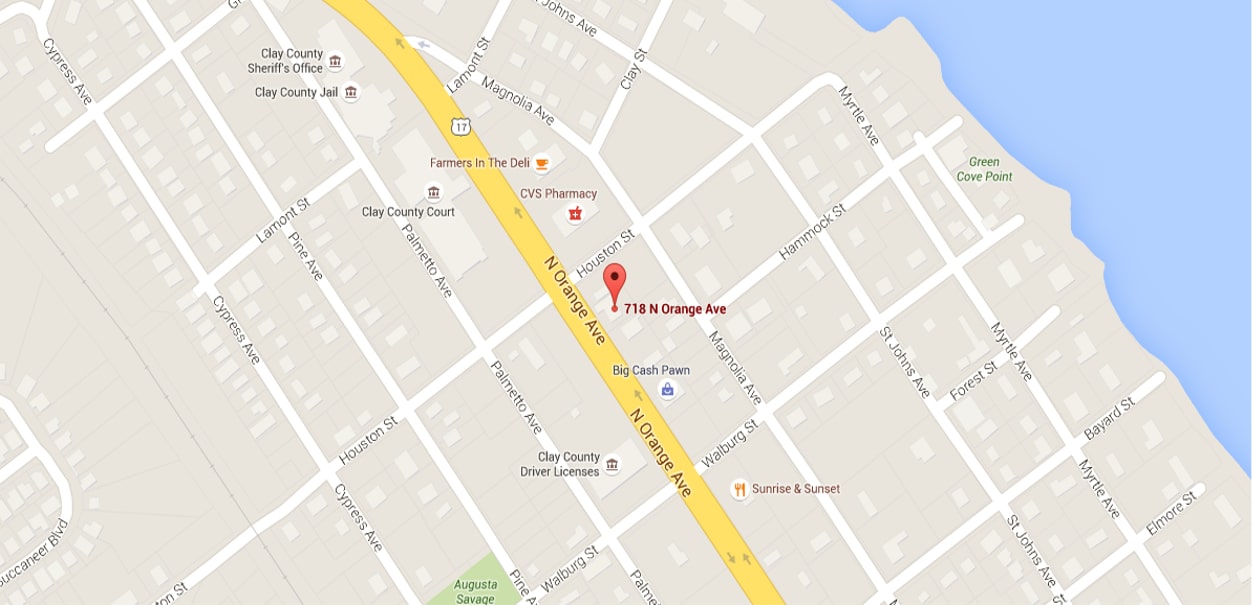

As a married same-sex couple, you may assume that you or your partner will not have any issues with asset transfer or scope or rights if the unexpected happens. Unfortunately, this may not be the case, and you may need to fight challenging legal battles. Therefore, it is crucial always to have the guidance of an estate planning attorney by your side. At Arnold Law, we believe that everyone should have equal rights, and we will help you protect your rights and that of your partner throughout the estate planning process in Florida. Contact us at 904-264-3627 today for assistance and guidance with your same-sex estate planning needs.