Sorting through the personal possession of a deceased amid the emotional healing process can be stressful. However, given that we live in a money-motivated culture, it's no wonder that potential inheritors want a piece of an estate that has been left behind by a deceased person.

Hiring a probate attorney can help you avoid the many issues that come with probating a will. It also gives family members peace as they go through the emotional turmoil of losing a loved one. At Arnold Law, we aim at offering the best legal services to anyone seeking probate services. Please schedule an appointment with us today, and let's help you go through your probate process smoothly. When hiring a probate attorney, particular things should be considered, including:

Understand What a Probate Officer Does

Many people come to know about the existence and importance of a probate lawyer when they are executors or beneficiaries of a deceased's estate. A probate attorney usually guides the executor or beneficiaries of an estate through the probate process, identifying the assets and beneficiaries and distributing the inheritance.

Probate attorneys are also referred to as estate attorneys and are usually involved in several ways based on the particular circumstances of an estate. Their involvement depends on the value of the decedent's assets and whether or not they had a will before they passed away.

In cases where there's no will, beneficiaries usually file claims and sue for what they believe they're entitled to. However, challenges regarding the will's validity can arise even when there's a will, leading to possible litigation.

Specifically, probate lawyers are tasked with assisting beneficiaries and executors in the following ways:

- Collecting the proceeds from life insurance policies.

- Obtaining appraisals of the deceased's estate.

- Identifying and securing all the deceased's assets.

- Preparing and filing documents required by the probate court.

- Assisting in the payment of debts and bills.

- Resolving income tax issues.

- Managing the estate's checking account.

- Transfer of assets in the decedent's name to the appropriate beneficiaries.

- Making the final disbursement of assets to beneficiaries after paying all the taxes and bills.

Sometimes the role of a probate officer is confused with the task of a paralegal in an estate. Well, paralegals might be useful in filling out forms, but they are not useful when someone needs court representation. Typically, probate attorneys are essential when there is a probate process, although they are not legally required to do so.

A layperson cannot handle a probate process. It's time-consuming, and non-lawyers like paralegals can do something wrong or fail to give proper notice of a petition or hearing, forcing the matter to be postponed or dropped. Failure to do the right thing the second time might force the court to drop the petition, meaning that the person must start all over again.

Determine if Probate Services Are Necessary

Probably, you've been advised that hiring a probate attorney is the best decision that you must make to wind up an estate. Well, not all people seeking to benefit from the estate of a deceased person turn out to seek help from a probate officer. Sometimes, if the estate in question doesn't contain unique assets or isn't too large, you might be able to get by without a probate attorney's intervention.

Before you decide whether or not to go all alone, ask yourself the questions stated below, or better, ask your lawyer before you decide to hire one. If more of the answers to the questions are "yes," you can more likely wrap up the estate without a probate officer by your side. Some of these questions are as follows:

Whether you Can transfer the Deceased Person's Assets Outside Probate

The answer to this depends on how much the deceased had planned to avoid the probate process before his or her death. Some of the assets you can transfer without going through probate include assets in a joint tenancy, secured by an entirety, or through survivorship community property. Assets held by a living trust or named to a beneficiary also don’t need probate.

Whether the Estate Qualifies as a "Small Estate" Procedure

Most states, including Florida, use the summary probate procedure to streamline issues with assets and estate division. Under this procedure, estates are disbursed under an entirely out-of-court process that requires the presence of a simple affidavit to the executor or institution responsible for the asset.

Whether Family Members are Cooperative

It's rare to find Will contests, but once a beneficiary considers suing an estate, you should immediately talk to a probate attorney. However, solving this kind of problem outside the court would be reasonable since probate lawsuits can tear families apart and drain a lot of money from the estate in question. A good probate attorney should negotiate with the beneficiaries to reduce the possibility of a court battle.

Whether The Estate in Question Contains Complicated Assets

Things can become more complicated when an estate has a business, commercial real estate, or other types of assets that need special handling. You'll probably want to consult an expert on this since managing, appraising, or selling a business isn't a job for amateurs.

Whether There's Adequate Money to Pay Off All the Debts

When there's money to pay off legitimate debts like income taxes, funeral costs, and last illness costs, you won't have to decide which debt to pay first and which to handle later. However, when your initial investigation reveals that the estate doesn’t have enough money to pay off debts, it's necessary to seek legal advice before you start paying these bills. State laws allow creditors to prioritize certain debts over, and only a probate lawyer is experienced enough to help you in this process.

Whether the Estate is Too Small to Owe Federal or State Estate Tax

There are greater chances that your loved one's estate owns state tax and probably a federal estate tax, depending on how big it is. If so, you'll need an expert in legal and tax advice if your estate should file estate tax returns with Florida taxing authority or the IRS.

Manage All the Probate Issues Related to the Funeral Home

In most cases, funeral home expenses are prepaid since, most of the time, funeral homes don't provide any services unless they're paid. People can prepay funeral home expenses in a funeral contract or use the available liquid funds. Some funeral homes can also work out an arrangement with you if your loved one had an insurance policy, and probably you can't access the funds at the bank.

If you are an executor, you'll probably be tasked with preparing the funeral service. The time and nature of the funeral service depend on the family's or deceased's religious faith. It's crucial to involve family members of the decedent to prepare for the service. You should also involve clergy members to review the service. Other crucial steps in preparing for the funeral include:

- Preparing remembrances and photos for the funeral reception.

- Contacting the venue which you wish to hold the reception.

- Delegating tasks to others if you cannot handle some of the delicate assignments.

Order The Death Certificate Forms

You can order as many as ten death certificate forms depending on the number of assets and debt accounts that an estate has. You can seek both long and short death certificate forms. The long-form includes the cause of the decedent's death in it, while the short form doesn't. The death certificate is necessary for applying for admission of the Will in the Probate Court, change of ownership of a joint account, and obtaining date of date values of investments made by the decedent to guarantee prompt estate tax returns.

Death certificate forms are necessary while proving the decedent's death, although the funeral home typically notifies the decedent's source of income once they receive his or her body. However, if they don't contact these income sources, it might bring a little hassle if you are not keen enough. For instance, if Social Security pays money after a beneficiary has passed on, their dependents must return the payment to social security.

Be Realistic About Potential Family Resistance

It's common to experience family drama during a probate process. This can happen even when the deceased leaves the most detailed wills. If you sense trouble ahead before executing your loved one's wishes, it's recommendable to share this information with the probate attorney.

You can't prevent a family member from contesting a will. Knowing that they will meet resistance will help both of you prepare. You can even go further in collecting additional documents that would support what the will outlines.

If you are the will's executor, it means that you're responsible for distributing the estate according to the wishes of the decedent. However, they should understand that they're responsible for paying off any debts that the decedent had. Therefore, it's your mandate to carry out the decedent's final wishes and paying off the debts even when you put yourself in a position that compromises the position of the family members.

Gather All Necessary Documents

The probate process does not fall squarely on the shoulders of an attorney. You must gather several essential details. The more organized and prepared you are, the smoother the process will go. This holds before and after the probate process.

Those who've been named as executors of the will should bring the following documents in their first meeting with the probate attorney:

- Copies of the death certificate.

- Latest Will of the decedent.

- Bank statements and other financial documents.

- A list of all the decedent's assets.

- A list of all names, address, and contact information of everyone named in the will.

- Lease agreements.

- Real estate deeds.

- Vehicle titles.

- Revocable living trust documents, including any amendments.

- Federal and income tax returns for the past three years.

- Federal and state gift tax returns.

- Stock and bonds certificates. If possible, an original certificate is needed for this process.

Apart from the documents provided above, it would be suitable to have informative documents with relevant information that you'll need to carry during the estate administration. These include the following:

- Recent account statements, including banking accounts, brokerage accounts, and retirement accounts.

- List of all known assets.

- Appraisal for high-value personal belongings.

- Existing bills like cell phone bills, utility bills, and credit card bills.

- List of all known debts.

Locate and Read the Deceased's Last Will

If you haven't already read the decedent's last Will, it's crucial to read it before contacting its beneficiaries. In most cases, executors learn about their responsibilities through the will. Therefore, unless you read the will, you'll not learn about the person tasked to oversee the probate process if you are a beneficiary. On the other hand, executors cannot learn about their responsibilities, which might lead to conflict among the beneficiaries, contrary to the decedent's wishes.

Asses and Sign the Documents Needed to Open the Probate Estate

There are different requirements regarding opening an estate with the probate court officially in every state and county. The estate lawyer and probate court clerks will help you find the necessary items needed in this process. All you need to do is hire a local probate attorney familiar with the local probate rules.

List all The Questions You'll Be Asking the Attorney

You don't need to hire the lawyer who drew up the decedent's will to go through the probate process. As long as you have the right documents and are probably given the right to execute the estate, you can go with a lawyer with whom you're comfortable. In that case, you must formulate questions that would help you pick the best professional. Some of the questions that you should ask include the following:

- How many probate cases have you handled?

- Are you willing to work with me even when I am willing to handle many probate work all by myself?

- What are your charges? Are they by the hour, flat, or have a different way?

- If we are required to file tax returns for the estate, are you willing to help?

- How long does the probate process take?

- How much do you think the probate process will cost?

- How many estate tax returns have you prepared?

Your goal should be to hire a competent attorney- who can handle the probate process effectively and efficiently, even in unusual circumstances. However, hiring an attorney who's been recommended by other local lawyers will probably reduce the hassle of finding one from scratch.

What may be necessary is finding a knowledgeable and experienced attorney and someone you are comfortable with. Firstly, you need someone you can communicate with clearly. Most lawyers tend to throw around legal terms to clients, which can be not very pleasant. You need someone who would put some effort to help you learn about the probate process, and if you wish, would probably do some of the work yourself.

Therefore, you don't just have to admire that school diploma framed and hung in the probate attorney's office in your first meeting. Pay close attention to how the attorney explains the process and how well he or she will listen to your concerns. You should also not make a decision immediately. Tell the lawyer that you'll make your decision promptly and call back.

Look for a Compassionate Attorney

Similar to other businesses, a probate attorney is providing services that you'll be paying for. However, probating a will is more than the money side of things. That's why you need to find a probate attorney who's available, sympathetic, and compassionate who can patiently answer your questions without annoying you. Some of the signs of a probate lawyer that might not be a suitable choice include the following:

- Someone who doesn't answer your phone calls and questions.

- Someone who makes a rash decision.

- Someone who doesn't explain details about the process.

- Someone insensitive to your situation.

- Someone unavailable.

On the other hand, you would expect a reliable attorney to have the following characteristics:

- Who is available to answer your questions.

- Who doesn't take a side during the probate process.

- Who explains the probate process in detail.

- Who is sympathetic to your needs and your recent loss.

- Someone who's forthcoming with all information.

The best way to choose someone sympathetic is by trusting your gut instincts. Consider someone who makes the first meeting smooth and doesn't feel rushed. You should also not be afraid to interview several attorneys before you decide on one.

The Risk of Handling a Probate Process by Yourself

Most executors choose to deal with an estate by themselves. But is this a wise move? The reality is that probate is usually a complex process, even when the estate seems to be small and straightforward. If you decide to handle the probate process, you must consider whether you will handle calculating the tax liability and taking on other liabilities that come along. Below are a few risks of handling a process by yourself that you should learn.

You are Personally Liable

As an executor, you should be aware that you can end up incurring costs out of your pocket if one of the beneficiaries does not receive their rightful inheritance. For instance, failure to obtain the true value or if an unknown beneficiary comes along after completing the distribution process can greatly affect you. You cannot plead ignorance to avoid payment.

Remember, you must pay off all the estate debts, and all beneficiaries must receive their fair share. The only way to avoid putting yourself at risk of personal liability is by engaging a probate attorney with the appropriate training and experience to handle this process.

Valuing the Estate Might Be Difficult

You might be required to state the value of the estate before applying for probate court rulings. The best thing to go through this process involves a probate attorney, who would consider the most detailed aspect, including the amounts of gifts received by the estate.

Calculating Tax Can be Challenging

Most estates come with tax issues that should be calculated. This requirement can be challenging to anyone without enough tax knowledge. Simultaneously, it’s challenging to take advantage of tax reliefs that come with the estate. There are other complicated aspects of calculating tax for an estate, and this can significantly derail your attempts to make a smooth transfer and sharing of the estate among its beneficiaries. However, relying on a probate attorney would ease this process based on the extent of their knowledge.

There are Risks of Unexpected Claim

The growth of extended families means that there is an increased risk of unexpected claims by unknown beneficiaries. Suppose you decide to handle the probate process, and someone you don't know makes a formal claim against the portion you are entitled to share? Well, this can be challenging since you could end up being personally liable if the beneficiary's claim is successful.

Unless you've publicly notified all creditors of the decedent through proper advertisement, you might end up incurring some liability from unexpected claims. This usually comes due to the lenient requirement that provides crucial protection when this kind of claim arises.

DIY Probate Is Sometimes Not Cost-Effective

The reality is, if you try to handle the probate process by yourself, you might end up missing essential steps that would lead to a costly mistake. It’s sensible to invest in a probate lawyer who's backed with professional indemnity insurance. You will have the reassurance that the attorney will administer the estate properly according to the law, which gives you peace of mind amid an emotional time for you and your family.

Find the Best Probate Attorney Near Me

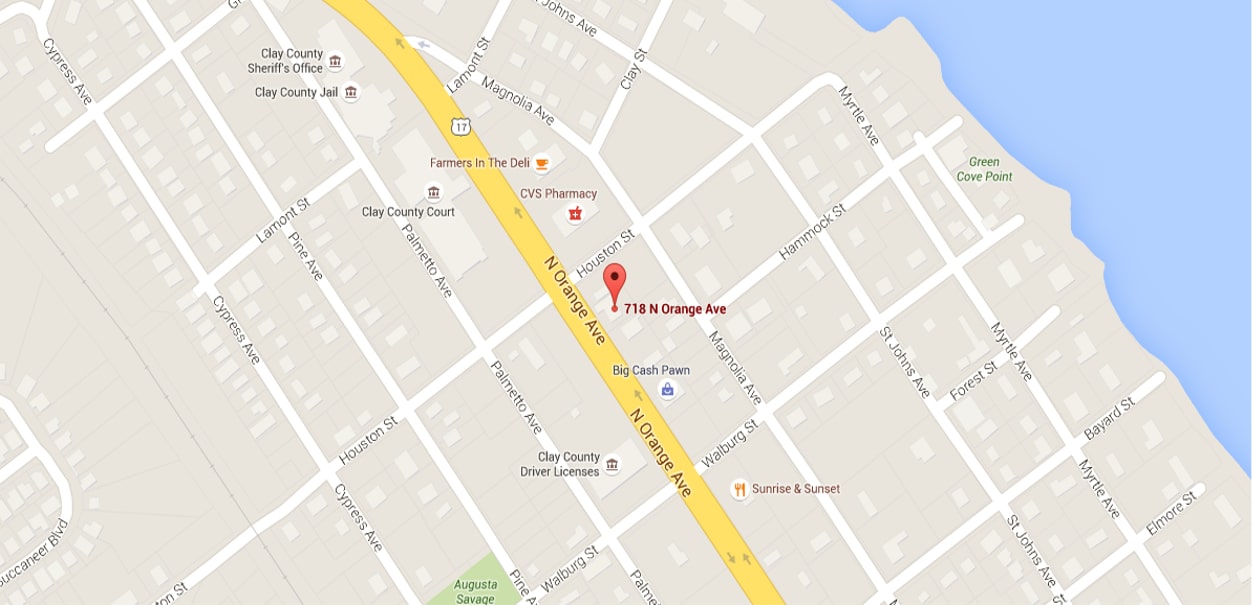

If you feel that handling the probate process is tough, you want to hire a probate attorney. We can take the process off your hands and make the whole thing as stress-free and simple as possible. At Arnold Law, we offer complete probate services backed by our vast experience in this situation. We will designate a probate attorney who will help you through the entire process until its completion once you contact our services. We know it can be difficult to lose your loved ones, and probate is often the last thing you'd want to do. That's why we are committed to offering the best services to all our clients. Contact us today at 904-264-3627 and talk to our professionals.