Having a power of attorney (POA) is essential for a comprehensive and robust Florida estate plan. The legal document lets you transfer your assets' authority, including investment, spending, and managing property owned jointly or individually. It is an effective method of preparing for your future since it protects your property's management if you become incapacitated.

However, since you are giving control of the real estate to somebody else should something occur to you, you should be diligent and careful when drafting the document. Consequently, you should seek the legal assistance of Arnold Law. Our experienced estate planning legal team can ensure supervision and diligence over POA creation and, if necessary, its administration and execution.

Defining Power of Attorney

Part II of Chapter 709 of the Florida Statutes controls power of attorney (POA).

POA is a legal authorization that gives a designated individual (the attorney-in-fact or agent) the power to act for another person, the principal. The principal can give the agent limited or broad authority to decide the principal's finances, investments, or property.

Types of POA

The form of POA you create varies depending primarily on your needs. The power you give can be general or specific. Here are different types of POAs:

- General — It gives your attorney-in-fact broad authority. The agent can make financial transactions such as selling or purchasing real estate, filing taxes, and dealing with government agencies.

- A durable POA gives the agent the authority to remain effective even following an incapacity. The durable POA can be either specific or general. For your POA to be durable, your document should indicate that your subsequent incapacity does not terminate your POA, except as underlined in Chapter 709 of Florida Statutes.

- Special or limited is typically used when a principal wants to give an agent authority for a limited duration and a particular purpose. For instance, if you are traveling out, you will designate a person to close your real estate transaction. Once the period or purpose ends, this authority terminates.

Please note that as of 2011, Florida law no longer allows springing POA. Instead, POA should become effective immediately. Otherwise, it is invalid.

Why You Need a POA

The benefits of a detailed real estate POA are numerous. The section below intends to discuss these benefits.

- Avoids the necessity of a conservatorship or guardianship — A person who does have a POA when they become incapacitated will not have an alternative but to have another person file a petition with the court to appoint a conservator or guardian. Typically, the court will appoint an individual to manage the incapacitated person's real estate and financial affairs. The court will also continue monitoring the situation provided the incapacitated individual is alive. The process is expensive. It is also devastating because the property owner does not have input on who is appointed.

- Offers family members an opportunity to discuss real estate desires and wishes — There is a lot of consideration when it comes to creating a POA, including the most appropriate attorney-in-fact. When a loved one or parent decides to have a POA, it is an opportunity for the parent to deliberate their real estate wishes, expectations, and goals with their family and the agent. It also prevents questions and disagreements on the principal's desires once the principal is incapacitated.

- Provides peace of mind — Estate planning and advanced planning can save your family from making decisions for you on short notice and when emotionally distressed. Do yourself and your family a favor by making this decision while you are healthy and mentally sound so you can ensure your wishes and desires are executed when the need arises.

Legal Requirements of Real Estate POA

For your POA to be valid, it should satisfy the requirements below:

Mental Capacity to Create a POA

The principal should have the necessary mental capacity to sign their legal document.

Individuals are mentally competent provided they can understand the risks, responsibilities, benefits, rights, and potential consequences involved in their decision. Having a physical or mental disorder does not automatically mean that person is incapacitated; there should be a specific inability to make and comprehend decisions.

You Must Execute the POA Under 709.2105(2) Florida Statutes

The principal and two (2) witnesses should sign the legal document and have it approved by the principal before a notary public.

Additionally, the principal should initiate specific enumerated powers if they intend to grant the agent the powers.

The Agent Should be Appointed and Accept Their Appointment

The law requires your agent to be at least 18 years. If you use financial institutions, they should have trust powers, business places within Florida, and be certified to perform trust business in the state.

How to Choose Your Agent

Any competent agent can function as your agent for a real estate POA. While this person does not need to be a financial expert, you should select an individual you trust and with a good dose of common sense. Here are factors to consider:

- Geography — If you can pick a person who resides nearby, some tasks like going to the bank or looking after your assets are more manageable in person.

- Marriage — If you are married, it is sensible to name your partner as the agent. It reduces conflicts between your spouse and agent over any co-owned asset. If this is not an option, select an individual you and your partner agree on.

- Multiple agents — Generally, it is wise to name more than one agent. It reduces conflicts. You also have a backup plan if your first-choice agent cannot serve.

Now that you understand why you require a POA and the best fit to be your agent, below are additional factors to consider when deciding who will function as the attorney-in-fact.

- What is your relationship with the individual you are contemplating? Will the individual have challenges handling your partner and children? If the agent is your child or wife, can they execute your wishes notwithstanding other family members' wishes?

- Does this individual have a partner who supports their decision, or will the spouse attempt to control their conduct about decisions that the agent should make on your behalf?

- Does the attorney-in-fact have problem-solving skills? Can they compromise when needed, but be assertive on your real estate wishes?

- Does this person have the desire and ability to prioritize your wishes and needs over their personal beliefs and financial issues when deciding about your real estate?

- If the attorney-in-fact will ultimately inherit the estate, is it sensible to put the individual in charge of managing the property?

Once you choose the agent and before creating your document, speak with the agent. It can be a difficult conversation. It is understandably challenging for a loved one to contemplate when incapacitated. Still, you need to be sure the person understands their responsibilities as an agent and is willing to take them on.

If you have challenges choosing an agent, consider consulting with an estate planning lawyer. Your skilled and knowledgeable attorney should explain everything you need to understand and assist you in making the right decision.

Duties of an Attorney-in-Fact

Your relationship with the attorney-in-fact is a fiduciary. In other words, your attorney-in-fact should act within the scope you have granted them under the POA. Despite the provisions in your document, an agent who has accepted your appointment should do specific things.

First, they should comply with your reasonable expectations to the level that the expectations are known. If your agent does not know your specific expectation, they should be dedicated to acting in your best interest.

Additionally, the agent should act in good faith. In other words, they should act honestly and reasonably with a reasonable basis for any conduct taken. Similarly, your agent should execute their responsibilities within their scope of authority. A POA can be specific, like paying your bills using a given bank account, or broad like managing your assets. An agent granted the power to pay bills will be acting outside their scope of authority if they sell your real estate.

Also, your agent should preserve your estate plan to a degree they know, provided acting so is in your best interest. Whether their conduct is consistent with your best interest is founded on relevant factors, such as the nature and value of the asset, your foreseeable responsibilities, taxes reduction, public benefits eligibility, and need for maintenance.

Moreover, your agent should act in a manner that does not lead to a conflict of interest that hinders their capability to act objectively in your best interest. For example, your agent investing your money in an enterprise belonging to them could result in a conflict of interest. Your agent could be hesitant to deprive you of your funds from the project even thorough that works for you because it can create losses for them. You can conceivably waive this responsibility, mainly if your agent is your child or a close relative.

Your agent should also maintain good records, including disbursements, receipts among other transactions made for you.

Except as otherwise provided in the POA, your agent should not disclose disbursements, receipts, or transactions made for you unless ordered by the court or requested by:

- You, the principal

- Another fiduciary acting for you

- A court-appointed guardian

- A government authority having authority to safeguard your welfare,

- Or upon your demise by your successor or personal representative in your estate's interest.

If requested, your agent should comply within sixty days from the date of the request or offer writing proving why they need more time and adhere to the request within the additional sixty days.

Limitations of an Attorney-in-Fact

According to Section 709.2201 of the Florida Statutes, your attorney-in-fact only has the power granted per the POA. However, your agent cannot vote in any public election, revoke or execute a will, perform their personal services under an agreement, exercise power as a trustee on their behalf, or make affidavits to their knowledge.

On top of that, you should also initial powers that give the authority to:

- Change or create rights of survivorship

- Make gifts

- Make an inter vivos trust

- Regarding a trust you have created or for you, amend, revoke, terminate, or modify the trust provided your trust instrument allows the settlor's agent modification, amendment, termination, or revocation explicitly.

- Change or create a beneficiary designation

- Disclaim assets and powers of appointment

- Waive your entitlement to be a beneficiary of a joint and survivor annuity

Most people believe that they can transfer assets to their name to evade probate as an agent. Nevertheless, unless you grant the initial authority to make gifts, your agent cannot dispose of assets. Even when you give the agent the power to make gifts, you can restrict the gifts and who receives them.

Unless gifting is essential for taxation purposes or you trust your agent to execute your best interest, avoid giving your agent gifting authority. If your agent uses their power to make gifts, particularly to themselves, other family members can be agitated by the conduct. It is particularly true when your agent is your child, and your other children are unaware.

A Comprehensive Guide on How to Create a POA

Discussed below is a step-by-step guide on how to create your POA.

-

Make Your Legal Document Using a Lawyer or Software

Some private firms offer templates or forms with blank spaces that a person fills out to make their legal document. For a user-friendly and seamless experience, they can use software that guides them through questions to achieve a document that satisfies their specific real estate needs and is binding in Florida.

Alternatively, they can also consult with a seasoned lawyer. Most attorneys will include a durable POA as an element of a detailed estate plan together with a living trust or will.

Whatever approach you use, creating your POA should include granting the agent either comprehensive or specific powers.

Unlike most states, a POA is not durable by default in Florida (it is not effective following your incapacitation). Under Section 709.2104 of Florida Statutes, the legal document should include words like, "The durable POA remains effective even after the principal's incapacitation," to be durable.

-

Sign Your POA In front of Two Witnesses and a Notary Public

As previously mentioned, you should have two (2) persons who should witness you signing the document and then sign it and have the legal document notarized.

-

Safely Store Your Original POA

After creating your POA, please keep your original copy in a safe space that family members can effortlessly access and notify them where to locate it. The agent will require the original copy before acting for you if you become incapacitated.

-

Give Your Agent a Copy of the POA

Moreover, you should give your agent a copy so that they are acquainted with its content.

-

Bring a Copy with the Lands Records Office

You should bring a copy to the Clerk of the Circuit Clerk and Comptroller's Office in Florida in the county where you have real estate. It allows the land records office to identify the agent's authority if they ever want to sell, transfer, or purchase real estate or take a mortgage for you.

-

Give a Copy to a Financial Institution

Additionally, you can give a copy of your POA to a bank or any financial institution that the agent will need to work with. It eliminates hassles for the agent if they ever use your POA.

When Do a Florida Real Estate POA Starts and Ends?

If you made a durable POA, the legal document becomes effective immediately after you signed it and had it notarized or witnessed. You can also instruct the agent not to use your POA until you are incapacitated.

POA ends following your demise or if you revoke it. Also, the designation of an ex-spouse as your agent is automatically suspended if any of the partners files for divorce.

Termination or Revocation of a Real Estate POA

Your POA can automatically terminate when one of the below happens:

- You die

- You become incapacitated if you do not have durable POA

- The court adjudicated you partially or totally incapacitated unless it determines that the agent should exercise specific power granted by the POA

- You revoke your POA

- The POA's purpose is accomplished

- The POA provided that it terminates

- Your agent's authority terminates, and the POA does not offer for another agent to act per the document

- Your agent dies, resigns, becomes incapacitated, or the court removes them

- Legal action is brought for the annulment or dissolution of your agent's marriage to you or your legal separation unless your POA otherwise provides

Suppose an individual initiates a judicial proceeding to determine your incapacity as a principal or for the appointment of a guardian advocate. In that case, the authority granted per your POA is suspended until:

- the petition is withdrawn or dismissed, or

- the court orders your agent to exercise any power granted under your legal document.

Should an emergency arise following initiation to decide on incapacity and before adjudication about your capacity, your agent can file a petition requesting the approval to exercise powers granted under your POA. The petition should set forth the property involved, the power the agent can exercise, and the emergency's nature.

Suspension or termination of an agent's authority is ineffective if an agent does not know about the suspension or termination and acts in good faith per POA. In other words, the conduct so executed, unless otherwise enforceable or invalid, is within the principal and their successors' interests.

You can revoke your POA by writing another document revoking your POA or by making a new POA and indicating the new legal document revokes all previous authority granted. Please note that having a new POA without explicitly revoking your previous POA does not revoke your prior document. It could mean you have at least one agent.

Can a Bank Refuses Your POA?

Florida law allows financial institutions to require more documentation like an agent's affidavit. A bank should accept the document, provided it is valid. However, there are exemptions. For instance, if the bank thinks in good faith that the agent does not have the power to perform the conduct requested or the bank knows the agent is abusing or exploiting you. Otherwise, the financial institution can face legal consequences if it fails to accept a valid document.

If the banks will not accept your POA, the initial step is finding out the reason. If you did not validly create the document, the solution is to make another POA.

Your Options If the Principal is Incapacitated

Suppose the principal is still mentally able to understand what they are doing when creating and signing the document and the costs of granting somebody else authority over their real estate. In that case, they can make another POA that settles all issues the bank raised. However, if the principal is incapacitated, the options are limited.

First, attempt to understand why the bank is holding up or denying approval. Acquaint yourself with Florida's POA laws and then resolve the matter.

If the back-and-forth does not pan out, seek legal representation.

Commonly Asked Questions

Discussed below are some of the questions that the legal team at Arnold Law has answered repeatedly.

-

How Does an Agent Differ from a Personal Representative or Executor?

A personal representative (also known as an executor) is an individual who manages somebody else's estate following that person's demise. The estate owner can name the executor in the deceased's will, and the court appoints them to administer the estate. On the other hand, an agent looks after the principal's real estate provided the principal is alive.

-

Is an Agent and a Trustee the Same?

A trust can authorize a person (trustee) to act on behalf of the trust maker during their lifetime. The trustee can manage the trust maker's financial affairs and control the trust's property. On the contrary, an agent can have authority over the principal's non-trust property. Another significant difference is that the trustee can continue acting for the trust maker following the maker of the trust's demise. Whether an agent or trust is the best tool for your specific real estate needs is a concern that an experienced attorney can address best.

Find Qualified Legal Representation Near Me

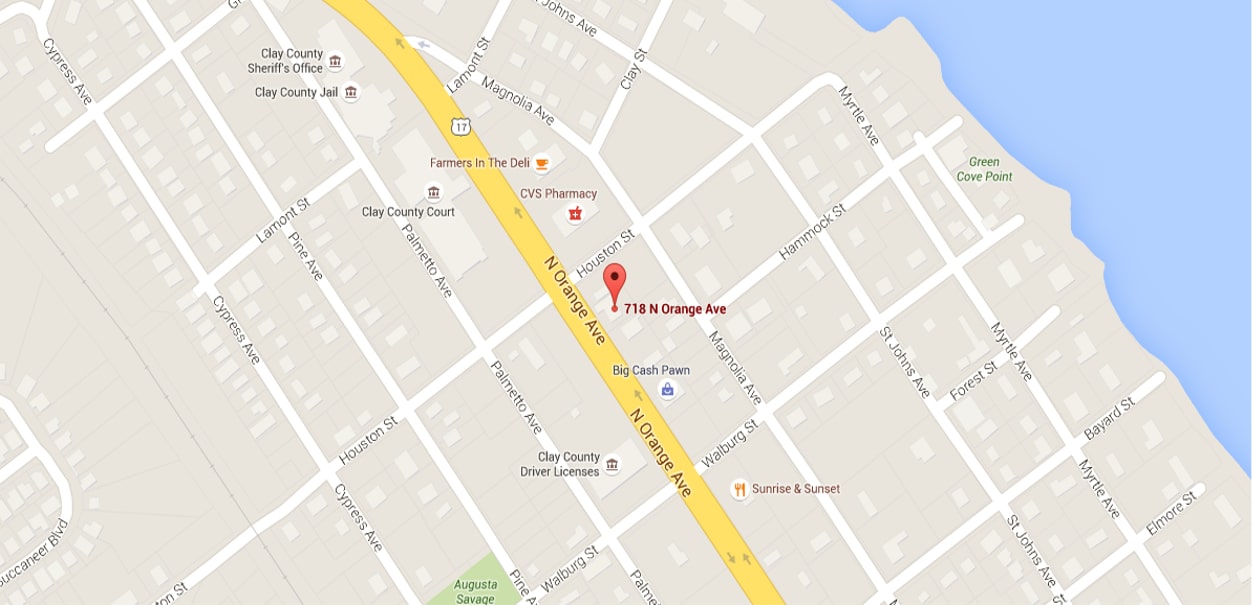

A POA is crucial in estate planning and real estate with significant impact. Consequently, if you are considering executing a POA, you should understand the rights you are handling over to your agent and ensure they suit your real estate goals and objectives. Engaging a skilled lawyer to determine which POA type best suits your needs is always recommended. The estate planning lawyers at Arnold Law can work with you to make your real estate POA, ensuring that your needs and desires are followed. Contact us at 904-264-3627 to schedule your initial consultation. We offer legal help to families in Florida.