An irrevocable trust is among the best and most valuable estate planning tools for accomplishing a wide range of financial goals. Creating one is an effective way of ensuring your family and loved ones are well provided for. An irrevocable trust is also a powerful tool to protect your property. However, to have a legally binding trust that meets your needs, you should have an estate planning lawyer highly skilled in trusts and estates and understands current laws, creating one for you.

At Arnold Law, we help clients looking to create irrevocable trusts designed to meet their specific needs in Florida. Our estate planning lawyers will use their decades of experience to assess your entire estate and listen to your goals to establish whether an irrevocable trust is an ideal option for your situation. If it is, they will ensure that all the aspects of the trust comply with your needs and prevent any errors that could cause future problems to you or your heirs. Contact us right away if you need help creating this kind of trust or have any questions.

What's an Irrevocable Trust?

An irrevocable trust is an agreement among you (the trustmaker/settlor), beneficiaries, and trustee that can't be amended or broken. You can't take back (revoke) assets you put into an irrevocable trust. You may not remove or add beneficiaries or change the provisions or terms of the irrevocable trust agreement. Transferring property to this trust is a permanent gift of assets for the benefit of other persons designated as trust beneficiaries. You can't change your mind about assets you've already put into an irrevocable trust. You create an irrevocable trust during your lifetime.

And even though you don't have the power to take back the property you transferred into the trust, change, remove/add beneficiaries or change the provisions/terms of the trust, you still make critical decisions at the outset. These decisions include deciding who'll be the beneficiary, naming the trustee, and selecting what property you will put in the trust and how it’ll be used.

By definition, all testamentary trusts are irrevocable since, by the time the trust officially comes into being, the trustmaker is already deceased.

Execution Requirements of Irrevocable Trusts

An irrevocable trust has to be properly executed for it to be considered valid. Under Florida law, should a revocable trust have testamentary provisions, it must be executed similarly as a will. This means it should be signed before a notary and two witnesses. Generally, the revocable trust will also have a self-proving affidavit.

Contributions to an irrevocable trust aren’t testamentary gifts but current gifts. Therefore, an irrevocable trust doesn't have similar formalities as a will.

How an Irrevocable Trust Works

After creating an irrevocable trust and transferring assets to it, the trustee you named maintains legal title while the beneficiaries hold equitable title. Technically, the trustee will take over— managing property for the benefit of the beneficiaries and making distributions in the way you instructed in the trust document. You'll not have title to the assets anymore. The discretion given to a trustee could be narrow or broad, but they always have to act in the best interests of the beneficiaries and in compliance with the trust terms. Usually, (but not always) beneficiaries are third parties (that is, someone that's not you). You can also be a beneficiary, although an irrevocable trust's functions are limited when you're also the beneficiary, as we shall see later.

In most cases, because it's an irrevocable trust, you can't reverse the effects of the trust to reclaim the assets except if you have the trustee and beneficiaries' consent. However, we have cases where you can modify your trust. Even so, it’s still deemed irrevocable since you can never modify it entirely on your own.

Irrevocable Trust Modification

As we mentioned, an irrevocable trust can’t generally be amended or revoked. However, several estate planning strategies and tools exist to modify its terms. These strategies and tools for changing an irrevocable trust vary in procedure, purpose, and scope. Some need agreement among the beneficiaries, some are subjected to judicial proceedings, and others only require your actions as the trustmaker.

For many people, the requirement to amend their trust arises because of changes in different circumstances. There are several circumstances under which modifying an irrevocable trust is necessary or desirable. These include:

- Changes in federal or state tax and inheritance laws.

- Revised personal estate planning goals, preferences, or beliefs.

- Changes in the needs of the trust's name beneficiary/beneficiaries.

- Change in the family or individual financial condition.

- The birth or death of a family member.

How to Modify

We have four primary ways of modifying an irrevocable trust in Florida. They are:

- Using the state's decanting law.

- Asking for a judicial modification.

- Entering into a non-judicial agreement.

- Through the reformation process.

Trust Decanting

If the trust's distribution standards permit a trustee to distribute the property in a trust for any reason or purpose, then they can distribute all those assets to another trust that has more favorable terms. This is called decanting. Generally, decanting a trust is considered an income tax, gift, and estate-neutral event. But we have exceptions, and careful tax planning is crucial if you wish to use the decanting method to modify irrevocable trust terms effectively. Apart from the reasons provided above, other reasons why you may want to use the decanting method to replace the terms of an existing irrevocable trust include:

- Adding appointment powers for beneficiaries so they can alter the ultimate distributees of the trust.

- Changing distributions to comprise special needs provisions.

- Splitting and consolidating trusts.

- Correcting drafting mistakes.

- Providing property protection.

- Achieving tax planning.

- Limiting the beneficiaries' rights to acquire information concerning the extent and nature of their interest in the trust.

- Revising trustee's compensation.

- Expanding trustee's powers.

- Affecting administrative changes in outdated documents to give more flexibility.

Judicial Modification

Per Florida Trust Code, a qualified beneficiary or trustee may file a petition seeking to terminate or modify an irrevocable trust if the trust purposes have become impractical, wasteful, impossible, or illegal to fulfill or have already been fulfilled. Judicial modification is also allowed if, because of circumstances not expected by the trustmaker, complying with the trust terms would substantially impair or defeat the achievement of the trust’s main purpose.

Courts have a wide discretion to terminate, modify, or order action if they believe it is necessary under the law. For example, a court might modify an irrevocable trust even to the extent of altering its distribution terms, and in so doing, found it might take into account extrinsic proof as its discretion.

Non-judicial Settlement Agreement

The state's law permits interested parties to sign a binding non-judicial settlement agreement to resolve any trust problem, as long as that resolution isn't unlawful under the applicable Florida Trust Code provisions. A non-judicial agreement permits trust issues to be resolved informally without the expense and time of litigation. The law dictates that the trustmaker and beneficiaries may change an irrevocable trust by consent through the execution of a non-judicial settlement agreement. Furthermore, a trustmaker may, without permission from the beneficiaries, modify irrevocable trust terms if they give up privileges in favor of the beneficiaries.

A non-judicial agreement is considered invalid should it generate an outcome that isn't authorized under the Trust Code. Consequently, the kind of issues that a non-judicial agreement can solve are:

- The construction or interpretation of the irrevocable trust terms.

- The appointment or resignation of a trust’s

- The approval of trustee's accounting or report.

- A directive to the trustee to stop performing a certain act or give the trustee the desirable or necessary power.

- A trustee's liability for trust-related action.

- The establishment of the trustee's compensation.

The Reformation Process

Reformation is a legal action that seeks to reword errors or correct mistakes in a trust to ensure it accurately reflects the trustmaker's original intent. Once the trustmaker or any other interested party applies for reformation, the court might modify the trust terms even if the terms are unambiguous to conform the trust terms to the trustmaker's intent. The person applying reformation has to show, by clear, convincing proof that the settlor's intent and the trust terms were impacted by a mistake of fact or law.

To determine the trustmaker's initial intent, the court considers proof relevant to their intention, although the evidence contradicts the apparent, plain purpose of the trust. A reformed irrevocable trust relates to the time the trust was created.

Reformation is usually a straightforward process, especially when the ambiguity or error is clear. However, this process has various limitations compared to the other irrevocable trust modification options. As we mentioned, the bases for seeking reformation are limited. Also, unlike the other modification options, reformation won’t necessarily facilitate further modifications to the trust terms going forward.

Dissolution of Irrevocable Trusts

An irrevocable can be dissolved per the terms in the trust document. Many people wish to understand how an irrevocable trust can be dissolved after the trustmaker dies.

A typical irrevocable trust document allows the trustee to dissolve the trust if it's not economically feasible to maintain it (the trust) for the beneficiaries. Put otherwise; if the assets in the trust diminish to an extent there's not much left in the trust estate, the trust document allows the trustee to dissolve that trust. In certain cases, the law also allows the trust to be dissolved if all the beneficiaries consent.

Irrevocable Trust Benefits

Transferring your property in an irrevocable trust comes with several benefits, including asset protection over a long period. This trust also allows a disabled party to have an unrestricted number of properties held for their use without impacting their eligibility for particular government benefits. The trust enables you to evade guardianship should you become physically or mentally impaired to the extent that you can't decide for yourself. Additionally, it enables you to distribute property to your beneficiaries without going through the probate process.

Most importantly, this trust is a tactical way of protecting an elderly's property from being consumed by nursing home care expenses. The property in the irrevocable trust won't be accessible to be utilized to pay costs for an assisted living residence or a nursing home. This means the elderly individual can obtain financial assistance from Medicaid.

-

Asset Protection

Florida law dictates that property placed in an irrevocable trust be safeguarded from the trust beneficiaries' lenders. The two most critical legal principles providing property protection to the beneficiaries of irrevocable trusts are:

- The discretionary distribution protection.

- The spendthrift asset protection.

Discretionary Distributions

There's separate protection of beneficiaries' interest in irrecoverable trust agreements that grants the trustee power over the timing and amount of distributions to trust beneficiaries. These irrevocable trusts are called discretionary trusts.

Florida law provides that beneficiaries' creditors can't force a trustee to distribute principal or income to the trust beneficiary if the distribution could become susceptible to the beneficiary's lenders. This protects against compelled distribution irrespective of whether or not the trustee might have abused their discretion.

Many spendthrift trusts have discretionary distributions. But the legal protection from lender judgments of discretionary distributions is different from the protection the spendthrift clauses provide.

However, if the trustmaker and beneficiary are one person, the trust is termed a ‘self-settled trust.’ With self-settled trusts, a settlor’s creditor can reach the maximum amount of the assets distributed for the settlor’s benefit. For instance, if the trustee is granted the power to give the trustmaker as little or much as they believe appropriate concerning the trust, the lender may reach all the assets regardless of the trust agreement having discretionary distribution or spendthrift provisions.

The Spendthrift Protection

You can include a spendthrift provision/clause in the irrevocable trust agreement to protect your beneficiaries' interests from their creditors. This clause limits a beneficiary's capability to sell, give away, transfer, convey, or assign their rights in the trust or beneficial interest. It's called a spendthrift provision/clause since it was originally meant to prevent imprudent beneficiaries from purposely squandering their inheritance by giving their beneficial interest to someone else.

The idea behind spendthrift protection is that a trust beneficiary's lenders can't force the beneficiary to involuntarily do what they can't voluntarily do per the trust agreement. Therefore, when you prohibit your beneficiaries from voluntarily assigning their trust interest to someone else, then the beneficiaries' creditors can't compel them to involuntary assign the interest to pay their debts.

Courts in Florida have frequently applied asset protection to an irrevocable trust. Per the state's law, a spendthrift clause has to expressly prevent both involuntary and voluntary transfers of beneficiaries' interests to safeguard the interests from lenders. After the trustee distributes assets from a spendthrift trust to a beneficiary, the funds in the beneficiary's possession aren't protected from their lenders by the spendthrift clause anymore.

Under Fla Stat. 1736.0503, there are two exceptions to the spendthrift protection. The first exception applies to special creditors, including the beneficiary's former spouse and child. The law prevents the spendthrift clause from applying to the beneficiary's former spouse or child concerning alimony or child support claim. The clause is also not enforceable against the government or against claims by lenders (such as a lawyer) who have offered services to protect a beneficiary's interest in the spendthrift trust document. Special creditors could garnish a beneficiary's distributions and interest from a protected spendthrift trust.

Secondly, the law forbids a trustee from holding on to a distribution required by the irrevocable trust agreement only to protect that distribution from the beneficiary's lenders. An overdue mandatory distribution could be garnished from a spendthrift trust.

-

Tax Relief With Irrevocable Trust

If you're looking to minimize estate tax, you can create an irrevocable trust so you can be relieved of any income tax liability from the income generated by the assets. This way, you may avoid estate taxes. Currently, the gift and estate tax exemptions are very generous. You're permitted to give fourteen thousand dollars per year without being subjected to taxation. Also, you may give more than 5.45 million dollars in your entire life without being subject to taxation, or more than 10.9 million dollars if you're married and your spouse hasn't used their lifetime exemption.

-

Probate Avoidance With Irrevocable Trust

When you place assets in an irrevocable trust, they aren’t yours anymore. Only assets belonging to you are subject to probate. Therefore, a property funded by an irrevocable trust can help you avoid the probate process.

-

Estate Tax Planning With an Irrevocable Trust

Irrevocable trusts are frequently used for estate tax reduction. When you put your assets in an irrevocable trust, you give up all control and ownership rights over the assets (although you could still benefit from the property). Since the assets are not yours anymore and you cannot control them, they are not included in your taxable estate, so you won't have to pay taxes on the assets.

The only disadvantages of an irrevocable trust worth mentioning are that it isn’t easy to modify or revoke, and it may incur higher tax rates on income.

Irrevocable Insurance Trust

An irrevocable trust does more than just protect assets. A prevalent example is owning a life insurance policy. An ILIT (irrevocable life insurance trust) refers to the trust you create to own a life insurance policy. An ILIT can't be modified, amended, or rescinded just like any other irrevocable trust. Once you contribute a life insurance policy to the trust, you can't later reclaim policy ownership or alter the trust or policy terms. However, there are a few exceptions.

An irrevocable insurance trust is at times utilized to plan estate taxes. If you structure your ILIT properly, the death benefits you pay to the trust won't be included in your taxable estate for purposes of the estate tax. Additionally, you could also structure the ILIT so the trustee can distribute funds to your spouse without the money being included in the spouse’s taxable estate. An ILIT comprising discretionary distributions or a spendthrift clause protects the death benefits kept in the trust from the beneficiaries' divorced spouses or future creditors.

Self-Settled Irrevocable Trusts

Self-settled irrevocable trusts are trusts where the settlor is also one of the beneficiaries. Put otherwise; you create this trust for your benefit. Self-settled irrevocable trusts don't provide asset protection benefits.

The state's law expressly provides that irrespective of whether a self-settled trust document comprises a spendthrift clause or not, the property you transferred to your trust is open to your creditors' claims. Courts in Florida have denied lender protection to self-settled trusts for public policy reasons.

The Difference Between a Revocable and Irrevocable Trust

An irrevocable and revocable trust differ in several ways. One primary difference between these two is how each trust is modified or revoked. You can freely change or revoke a revocable trust any time before you die. If you acquire new property that you want to put in the trust or decide to change the trust beneficiaries, you can do that by simply executing a trust amendment. Through this amendment, you can make as many changes as you want. This is not the case with irrevocable trusts. Generally, irrevocable trusts can't be changed after signing except under specific circumstances, as we discussed above.

A revocable trust also allows you to maintain ownership over the assets you place into the trust. With an irrevocable trust, you no longer have control over the property you put into the trust since you effectively give up ownership of those assets.

Find a Probate and Estate Planning Attorney Near Me

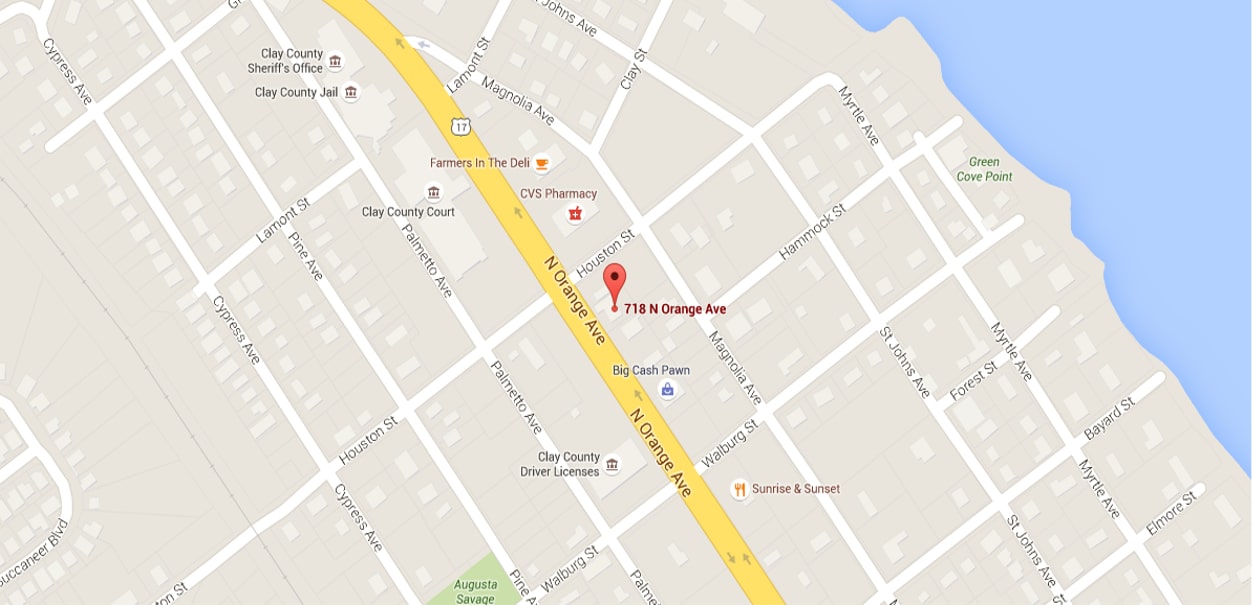

If you’d like to learn more about irrevocable trusts or need to create one in Florida, contact Arnold Law for help. Any trust document should be prepared only by an attorney who knows the complexities and challenges of asset protection provisions and one who understands your objectives. Our lawyers will give you sound legal advice, help you analyze your greatest concerns, and draft an irrevocable trust that will meet your needs. Call us today at 904-264-3627 for a consultation and to discuss your situation.