After the demise of a relative with a trust, the surviving loved ones go through trust administration. The person in charge of the administration is called a trustee. The trustee has several legal powers and fiduciary responsibilities to administer this trust in adherence to the trust agreement and act in the beneficiaries’ best interests. Typically, most trustees grieving the death of their loved one do not have legal experience, making a complicated undertaking more daunting.

At Arnold Law, we are dedicated to ensuring that you adhere to the trust agreement terms. We can prepare the required documentation and offer instructions, giving you peace of mind throughout this process. Also, we can assist you in filing the necessary Notice of Trust with the court, providing notices to all creditors and beneficiaries, settling debts, and distributing assets.

Defining Trust Administration

Florida trust administration is the procedures and responsibilities by which a living trust trustee executes the trust’s terms. The trustee has numerous responsibilities and powers that become effective after the incapacity or demise of the grantor or trust maker.

There are various benefits of choosing trust administration to plan your estate and protect assets, including:

- Avoiding probate — It can be time-consuming to have a will undergo probate. It means that the estate’s heirs have to wait for an extended duration to receive property that can assist them in providing for themselves and their families. Additionally, the probate process can be expensive. The cost can be up to 7% of the estate. Trust administration keeps the assets with your family.

- It allows flexibility —If you have a revocable trust, you can change the trust agreement terms at any time by executing amendments to the document. It permits you to be flexible and adaptable to different life’s changing circumstances. You can also add beneficiaries into the trust at any time.

- There is a reduced likelihood of your Interests and wishes being contested — When you transfer your property through a last will or testament, there are chances that a person will contest your will. Trusts are rarely consented because their creator is involved with the trust during their lifetime. It increases the events of the creator’s wishes being respected.

Trust Administration Checklist

To initiate a trust administration in Florida, here is a checklist to follow:

Review Your Trust Agreement

The initial step in trust administration is locating and reviewing the deceased’s estate planning instruments, including trust agreement, Living Will, and power of attorney (POA). Since the grantor has died, the living will and POA are invalid.

A written trust agreement outlines what you should do with trust assets following the demise of your partner. Generally, the trustee will hold the deceased spouse’s share of trust assets in trust for the benefit of the surviving partner. Following the demise of both parents or spouses, the trustee will distribute the trust property to charities or individuals named as trust beneficiaries. Ensure you create a list with beneficiaries, including their names, phone numbers, ages, email addresses, and addresses. Your lawyer can review the trust for you, aiding you with accounting.

Make the Necessary Filings

Deposit the decedent’s last will or testament with the Circuit Court Probate Division in the county of your residence during demise under Florida Statutes 732.901.

Obtain death certificates and record them in the county where the decedent’s assets are. You will probably require death certificates to acquire all life insurance policies and other transfers proceeds and remove the decedent from the asset tax rolls. You can obtain the death certificates at the funeral home at a fee. Ensure you acquire four copies of the death certificate that does not outline the cause of demise.

Obtain the taxpayer identification for the trust. You can do this online by bringing Form SS-4 to the Internal Revenue Service (IRS).

Finally, bring a Notice of Trust to the Clerk of Court or Probate Court. The notice aims to notify all interested parties, including creditors, that while the deceased does not have a probate estate, there exists a trust that the trustee should administer.

Acquire Authority to Act as a Trustee

If a person is named as a Successor Trustee, they should provide evidence of their authority to function as a trustee. Third parties like brokerage companies and financial institutions cannot give their details or permit the trustee to transact businesses for the trust unless the successor trustee has documents like:

- The grantor’s death certificate

- A trust agreement

- Trust agreement amendments

- Acceptance of Trustee Form

- Other documents relevant to a Trust Agreement provisions

Notice Requirements

Ensure you make the following notices:

- Ensure you notify all beneficiaries of your acceptance of the trust with your address and full name within sixty days following your acceptance of the trust.

- Unless the trustee has valid reasons not to act so, they must provide all beneficiaries copies of their trust agreement and amendments.

- Request the post office to forward mails to your primary address so you can obtain all the decedent’s mails, bills, and checks

- Notify telephone utilities and service

- Notify the human resources or personnel department at the deceased’s workplace

- Also, notify the credit card issuer, who will tell you more about the amount owed and close out the accounts. If the demise resulted from an accident, the issuer would offer an accidental death coverage.

- Notify the insurance providers — Ensure you obtain guidelines for bringing claims; notifying the insurer initiates the process. If the trust is the beneficiary, you should pursue benefits.

Assemble and Take Inventory and Custody of Property

As a trustee, you are obligated to find and take hold of the deceased property. Ideally, the grantor should have a schedule of their assets (individually owned and titled in the trust).

If their schedule is incomplete or there is none, the trustee needs to locate the decedent’s financial documents like:

- Statements from investment advisors and brokerages

- Bank statements

- Stock certificates

- Income tax

- Life insurance policy

- Deeds

You should also do the following:

- Ensure you gather supporting data for the ownership. After determining that an asset exists, acquire certificates, contracts, policies, and statements about the asset.

- Bring claims for Veterans, Social Security, and insurance benefits.

- Bring waivers and affidavits releasing assets from estate tax liens with the County Clerk’s office.

- Determine cash required for fees, taxes among other expenses, for settling the estate

- Prepare trust inventory with the date of demise value of the trust property and send each beneficiary a copy.

- Change trustee on open new accounts and existing accounts — For all investment and bank accounts, you should change the name of the trustee with authority to manage the account from the deceased to yours.

Determine the Decedent’s Debts

Make diligent searches to determine existing debts. Determine the debts’ validity, pay, and acquire receipts. You also have a responsibility to deny any payment of claims and defend it in court.

Administering the Trust

Gather all receivables and income due to the estate. You should also protect, preserve and invest the trust assets.

If a real estate is vacant, secure it from damage and vandalism. If its occupant is a tenant, review the lease terms and ensure you enforce its provisions. Notify the tenant that the property owner is dead and they should make future payments to you. You should deposit the collected rent in the trust’s bank account.

Finally, keep detailed records of expenses, estate transactions, and income.

Pay Due Taxes and Bring Tax Returns

The trustee should take inventory of the trust property. An inventory included lists of property titled in this trust and assets’ market value at the demise. The assets’ value affects future tax liability when beneficiaries sell an asset.

If the living trust becomes irrevocable following the trust maker’s death, you should use the trust’s federal Taxpayer Identification Number. You can obtain the number from the IRS Form SS-4. And if the trust has taxable income, bring IRS Form 1041S as the income tax returns.

Generally, many living trusts do not require estate tax reporting (IRS Form 706). You will only file the form if you have due federal estate taxes.

Estate Distribution

Ensure you carefully read and understand the trust agreement distribution provisions.

It would help if you made the distribution to all beneficiaries after paying all expenses and debts. If distribution equivalent to a specific fraction of the deceased estate is needed, the percentages are determined based on the estate’s net value after paying taxes, expenses, and debts.

If the trust provisions provide that you hold assets in the trust for particular beneficiaries’ benefits, you should hold and administer these assets.

You should maintain correct records about the trust assets, including all additions of income and principal.

Typically, you can make a partial distribution to all beneficiaries as your administration progresses, allowing you to hold property or money back to pay unforeseen liabilities. It would be best to make your final distribution after receiving and paying all liabilities. Otherwise, you will be held accountable.

Various Duties of a Trustee

The law imposes specific fiduciary duties upon a trustee, including:

Administering Trust

Per Florida Statutes 736.0801, after accepting the trusteeship, you should administer this trust in good faith in adherence with its purpose and terms and in the beneficiaries’ interests. Being a trustee is demanding. Sometimes some beneficiaries are unruly, demanding, and can pressure you to make potentially wrong and early distributions. That is why you should read and comprehend your trust agreement terms. The agreement outlines trust administration rules, and a competent attorney can help you understand your obligations.

You Should Exercise Loyalty

A trustee should also act in the beneficiaries’ interests during the trust administration. Some of the ways you can breach trust administration include:

- Living in trust assets and failing to pay rent

- Investing the trust property for your financial gain

- Offering loans with flexible terms to your friend or relative from the trust property

Ensure you avoid personal transactions. A breach of this duty can result in trustee liability and attorney fees.

Impartially (Florida Statutes 736.0803)

If the trust has at least two beneficiaries, you should act impartially when administering the assets regarding the beneficiaries’ interests. It is common in instances where the successor trustee is closer with some beneficiaries than others. You should act impartially and fairly to everyone.

Prudent Administration (Florida Statutes 736.0804)

As the phrase implies, the trustee should be prudent; manage or invest assets during trust administration consistent with the trust purpose. For instance, a trust tailored to offer a minor beneficiary cash flow would need you to invest in this property.

The trustee should have specialized skills. Otherwise, most trustees hire professionals like financial planners or lawyers knowledgeable on trust administration and litigation.

The final test per the law is the prudence of behavior. A trustee can delegate or make a proper investment decision but lose significant resources. Acting prudently will protect you even when things do not work as anticipated.

You Should Inform Beneficiaries and Account (Florida Statutes 736.0813)

It would help if you kept all trust beneficiaries reasonably up-to-date with your trust administration. The obligations include the following:

Within sixty days after accepting the trust, you should give beneficiaries notice of your acceptance of the trust and your address and full name

Within sixty days following the date you learn of the creation of an irrevocable trust or when you learn that a previously revocable trust is now irrevocable due to the settlor’s demise, you should notify the beneficiaries of:

- Settlor’s identity

- The existence of the trust

- Entitlement to request copies of any trust instrument

- Entitlement to accountings, and

- That the fiduciary lawyer-client privilege applies to you and your lawyer

You should provide the beneficiaries with copies of different trust instruments upon request.

As a trustee, you should give an accounting per Florida Statutes 736.08135, from the previous accounting’s date, or when you became responsible, to all eligible beneficiaries:

- Once a year, and

- After the trust termination.

This responsibility means you should update any beneficiary on the material occurrences and aspects during the trust administration. You should also give any beneficiary who requests material updates.

The obligation also requires you to give a Notice of Trust outlining beneficiaries’ entitlement regarding naming the trustee and accounting. Failure to respond timely to the request for an accounting or information is a breach of trust that could result in your removal as a trustee or liability.

Choosing a Trustee

Selecting the trustee to administer your estate after your death is crucial. Depending on your trust, your trustee will oversee your property. Most grantors choose either their loved one, a trust firm, or a professional trustee for the role. Below are considerations when making this decision.

Your trustee must be honest. If you cannot trust a person to hold one hundred dollars for you, you cannot name them as your trustee. If your relative lives from hand to mouth, bypass them.

If you select a loved one, they should be good at handling money and financially astute. You need a person familiar with the fundamental investment concepts and preferably an individual with investments with a professional investment advisor.

Other considerations to put into account include:

- Can the trustee treat all beneficiaries with impartiality?

- Can the trustee separate their feelings and interests from those of your beneficiaries and always exercise good judgment?

- Will your trustee be tempted to take undue risk in purchasing investments hoping for hefty returns?

- Will a person balancing their career and family have sufficient time to serve as a trustee?

Benefits and Disadvantages of Choosing a Loved One

Many people begin by considering their loved ones because they are their family and understand the family’s dynamics.

On top of that, the family members do not charge the trustee fee. While a cost-conscious client can see this as a plus, it might not be a wise decision. It can also result in disputes if the relative takes or fails the fee. Being a successor trustee is demanding, and your sister can resent you for not receiving payment while overseeing assets for your family, whom she perceived as ungrateful and unruly. On the other hand, your family can resent the relative receiving payment if she takes a fee.

The benefit of an accountant or lawyer serving is that they are familiar with the family members, mainly if you have worked together for a while. While the professional will charge more than your loved one, they charge less than a corporate trustee or trust company. However, they do not have the institutional structure of a trust firm.

A trust company brings oversight and structure to your trust administration. While it can be a costly endeavor, it is money well-spent. The company will make hard trust administration decisions. They can also say “No” to any beneficiaries when need be. Generally, using a company is advantageous when your beneficiaries are not in a friendly relationship, vast sums of money are involved, or you have a problematic beneficiary.

A disadvantage of using a trust company is that it can become inflexible. It can also be tightfisted when making the distribution if it reduces the property under management that they are investing in.

What Happens When You Cannot Name Your Trustee

First, contemplate co-trustees. You can name your relative and a trust company. While your loved one is familiar with your family dynamics, the skilled trust company will handle tough calls and trust administration.

Ensure your plan is flexible. Give your partner the power to replace a trustee. You can also allow your lawyer or beneficiaries to select the trustee after your death.

Do not finalize the estate planning document because you have reached an impasse on who should be your trustee. Consult with your attorney and discuss your concern to find solutions that suit your needs and interests.

What are Reasonable Trustee Fees

On average, trustee fees range from one to three percent of the total value of assets. For instance, a 3% fee can be considered reasonable for complicated and large assets that can take time to administer.

The Florida Supreme Court has set forth factors to consider when determining the trustee fees:

- The trust’s total amount

- Comparable fees for trustees in your community

- The trustee’s failure or success at their job

- Whether the trustee used or assisted the trust with their unusual or unique skills

- The trustee’s loyalty

- How much do the bank and trust companies charge?

- Responsibility and risk

- The trust administration timeline

- The trustee’s view of the value of their services

Notice of Trust

When a trust settlor dies, the trustee should bring a Notice of Trust with the court. The document notifies the court of the settlor’s demise and the trustee’s contact information.

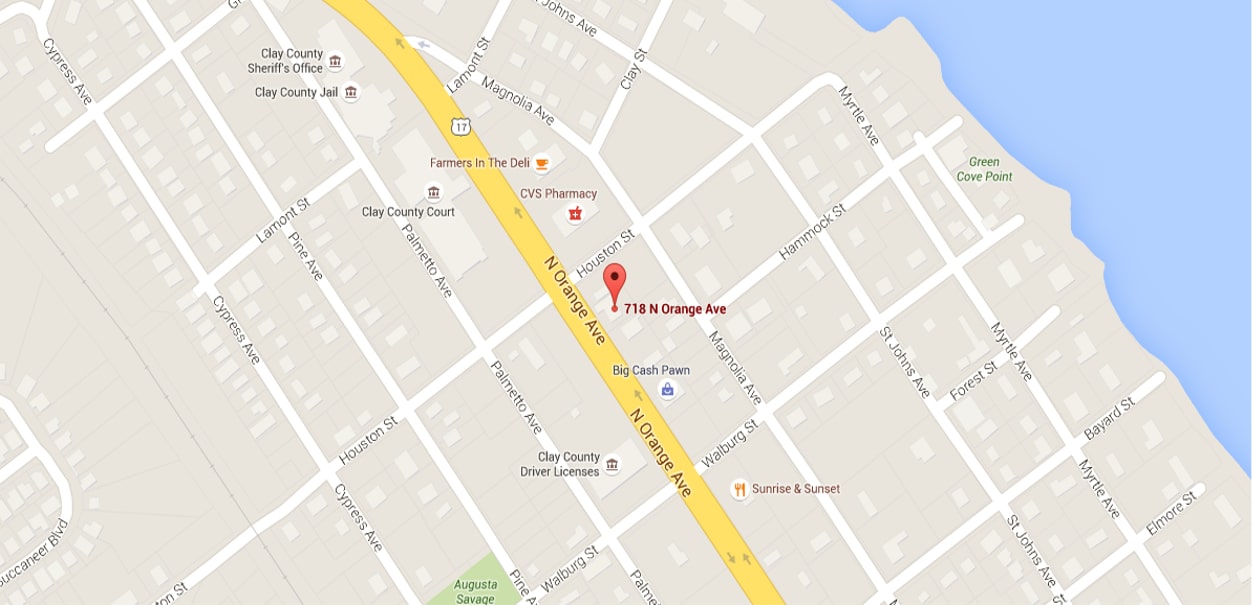

You should bring the notice to the court where the settlor is domiciled. For example, if the grantor resided in Jacksonville, the trustee should bring this notice to the Duval County probate court. A skilled estate planning lawyer can assist you in filing your notice appropriately.

A valid notice includes:

- The settlor’s name

- The settlor’s date of demise

- Title of the trust

- Trust’s date

- The trustee’s address and name

The Clerk of Court should also bring and index the Notice of Trust unless a pending probate estate proceeding exists. If one is pending, the clerk should file the notice in the probate proceeding and send a copy to the estate’s personal representative.

The notice does not reveal confidential information about the trust, like the trust’s beneficiaries and the value of the assets. Consequently, creditors do not know whether it is practical to pursue a claim against the trust.

Although trust administration does not go through the court-supervised process, it is wise that you consult an experienced lawyer before filing the notice.

Find an Accomplished and Knowledgeable Estate Planning Attorney Near Me

Grieving a loved one’s demise is challenging without adding the stress of trust administration. Instead of being given time to mourn, as the successor trustee, you will be required to find the grantor’s deeds, pay their debts and taxes, close bank accounts, cancel subscriptions, and distribute property to all beneficiaries legally and fairly. Even if you are gladly executing the trust terms, mistakes made during this process can have costly and long-lasting consequences. At Arnold Law, we are committed to making your role as an estate trustee as seamless and easy as possible. We can help you determine what should be done during the trust administration and find the most effective ways to realize your goals. Don’t hesitate to get in touch with us at 904-284-5618 to schedule your initial consultation and learn how we can help you.