Your estate plan as a Floridian is essential to your well-being. But beyond what you require, a well-established estate plan can create your legacy, safeguard your family, and protect everything for which you have worked. Unfortunately, estate planning laws keep changing, and understanding these changes is critical. This is one of the reasons why you need a trusted lawyer by your side.

At Arnold Law, we are dedicated to notifying you of any changes affecting your estate so you are prepared to plan it. Additionally, we boast in-depth knowledge about estate planning matters and can monitor your situation in line with the occurring changes to ensure you are protected under all circumstances. We serve clients throughout Florida, giving them legal advice on estate planning matters. Let us look at some of the changes in 2022 affecting your estate.

Estate Planning Overview

Estate planning refers to creating legal documents that govern what will happen to your assets once you die. Basic estate planning in Florida includes these documents:

- Declaration of preneed guardian appoints someone who would be your legal guardian should a court determine that you require one.

- A living will, which states your desire to terminate life-sustaining treatment.

- Health care directive, allowing another person to make health or medical-related decisions on your behalf should you be incapacitated.

- Power of attorney grants a person the legal authority to make decisions on your behalf.

- A will that governs property disposition after your demise and appoints your representative.

- Usually, Florida estate planning also includes estate tax planning and living trust.

Estate Planning Changes for 2022

Federal and State laws are constantly changing, and it is not unusual for an estate plan to also require review to incorporate these changes. For example, the recent federal estate tax laws adjustment significantly affected estate planning. Most estates expected to be eligible for the estate tax are now categorized under the substantially increased exemption and, thus, are not qualified for this tax in its present form. And the newly-established law permitting the portability of estate tax exemptions between married couples made it easier for well-planned estates to minimize tax liability. Let us look at the changes in estate planning in 2022.

2022 Changes in Federal Estate and Gift Tax Exemption

The estate tax is owed to the national government on a deceased person’s estate. The taxable estate entails all assets, property, stocks, bonds, business interests, and other riches at their time of death. Other deductions might be taken, for example, burial or funeral expenses, debts, or property values given to charities exempt from tax before computing the estate total. These taxes will apply only to estates worth a particular amount, though.

When you pass on, your estate is not usually subject to taxation by the federal government when its value is lower than the exemption value. If you die in 2022, the gift and federal estate tax exemption value will be 12.06 million dollars per person, up from 11.7 million dollars per person in 2021.

If you are married, this exemption value increases to a consolidated exemption of 24.12 million dollars. The changes have been attributed to the inflation adjustment. This means you could give out 12.06 million dollars of property during your lifetime without owing federal estate tax. And if you die and have an estate with a higher value than the mentioned exemptions, the estate tax rate will be taxed at 40 percent. Although, the 1st million will be taxed at a lower rate, and the remaining value will be taxed at 40 percent.

The treasury and IRS made it clear that the federal government does not intend to claw back any gifts given away between 2018 and 2025 that are above five million dollars for a person who passes on after or in 2026.

But according to the 2012 Act, the 12.06 million dollars exemptions will be terminated on 31st December 2025 and will be reduced to five million. Therefore, consult your lawyer if you own a big estate to understand how this could impact you.

Note that there is currently no state estate tax in Florida. However, it is critical to know that just because your estate is not subject to the federal estate tax, it does not mean it will not be subject to other taxes, like state estate tax. Most Florida residents reside within the state for a given part of the year and become residents of different states. If that state does impose state estate tax, you might be obligated to pay the tax.

Preparation for a demise beforehand, whether yours or your loved one’s, will enable you to devise ways of entirely reducing or avoiding estate taxes. Your lawyer can assist you in deciding what will effectively work for your money matters.

2022 Changes In the Annual Gift Tax Exclusion

Because of an adjustment for inflation, the annual gift tax exclusion value of 2022 has grown to 16,000 dollars annually per person or 32,000 dollars per married couple dividing their gifts. Put otherwise; you could give out gifts worth 16,000 dollars to as many individuals as you wish without incurring gift taxes.

Update on Build Back Better Act

The United States House of Representatives enacted the Build Back Better Act on 19th November 2021. The two considerable changes entailed in this Act are:

- A new 3 percent federal income tax on modified adjusted gross income (MAGI) above 500,000 million dollars for non-grantor trusts and estates or MAGI above 25 million dollars for unmarried parties and married couples filing jointly.

- A new 5 percent additional federal income tax on MAGI above 200,000 dollars for a non-grantor trust and estates or MAGI above ten million dollars for unmarried parties and married couples filing jointly.

These taxes are unchanged per the Build Back Better Act:

- Using grantor trusts to do estate planning

- The federal transfer tax exclusion amounts

- The top 40 percent federal transfer tax rate

- The top twenty percent federal income tax rate on qualified dividends or long-term capital gains

- The top 37 percent federal income tax rate on ordinary income

Required Minimum Distributions (RMDs) from IRAs and Qualified Retirement Plans

The IRS affected the new life expectancy tables on 1st January 2022. The purpose of these tables is they are used to determine RMDs from qualified retirement plans and Individual Retirement Accounts (IRAs). These new tables impact:

- A beneficiary of a qualified retirement plan or inherited IRA

- A qualified retirement plan participant who has reached their Required Beginning Date (RBD) for taking RMDs

- A traditional IRA owner who has reached their RBD for taking RMDS

The new life expectancy tables will reduce RMDs from IRAs and qualified retirement plans in 2022. This benefits taxpayers since the lowered distribution will lead to less taxable income and assist in continuing to grow and preserve the account's principal under favorable market conditions.

Consult your financial advisor or plan administrator on calculating your Required Minimum Distributions for 2022 utilizing the newly-availed tables.

Items that Remain Unchanged In 2022

The following are some of the items that remain unchanged in the calendar year 2022:

Federal Estate Tax Portability

In 2022, surviving partners can still transfer their decedent spouse's unused federal estate tax exclusion value to themself by filing federal estate tax returns.

Stepped-Up Basis

Even though there were congressional proposals in 2021 to alter the stepped-up basis, members of Congress did not approve those proposals. Therefore, in 2022, the income tax basis of an asset acquired from the deceased will still be adjusted to the asset's fair market value from the day of the deceased's death.

Federal Tax Rate

The highest GST, federal estate, and gift tax rates remain at 40 percent. The highest federal income tax rate for non-grantor trusts and estates is 37 percent, which applies to taxable income above 13,450 dollars earned by a non-grantor trust or estate during its administration period.

Probate Cut-Off

If in 2022, your estate's value is 184,500 dollars or less (up from 166,250 dollars), you could avoid a Florida probate. If your estate's value is over 184,500 dollars, probate might be triggered after you die unless you had transferred your property correctly into a revocable living trust.

2022 Estate Planning Changes Impact on Various Parties

Individuals With a High Net Worth

We mentioned that the federal estate and gift tax exemption value of 2022 is 12.06 million dollars per person and 24.12 dollars for married couples. However, this change is based entirely on a surviving spouse's lifespan for married couples. For example, if you remarry and agree to lifetime gifts, the figure may change. A surviving spouse might also be required to file distinct estate-based returns. In other words, you must be an ultra-rich individual or couple to incur federal estate tax under the new changes.

The back-door Roth working as an IRA contribution is no longer part of the 2022 changes. There is a possibility to do away with IRA conversions for married couples earning 450,000 dollars and singles earning above 400,000 dollars.

Retirees

Retirees above 65 years have a ten-dollar increase in their Part B premium payment. Provided you are over 65 and on Medicare, there is an increase of 21.60 dollars per month. This means you should be receiving 170.10 dollars instead of 148.50 dollars. But if your earned income as a retiree is 91,000 dollars or higher, Related Monthly Adjust Amount (IRMAA) will raise the premiums.

This comes down to income earnings that can hit a value as high as 578.30 dollars per month. You may also have seen new Medicare premiums, deductibles, and co-payment changes in 2022.

As far as maximizing Social Security is concerned, retirees above 70 can enjoy more perks. If you hit 70 years in 2022, you can receive Social Security benefits on your birthday with a 32 percent increase on your monthly payments, provided you are alive.

Low-Income Residents

The increased cost of living means that Social Security SSI (Supplemental Security Income) payments also increase. Admittedly, low inflation has not affected these payments since 2009. You may be unaware, but the Cost-Of-Living Adjustment increase of 2022 is the most significant of the last four decades.

Social Security and SSI benefits have increased by 5.9 percent, and residents started experiencing the changes in January 2022. In total, approximately eight million SSI recipients have experienced this growth.

The actual amount has now risen from 794 dollars to 841 dollars in 2022. Generally, most people are experiencing the highest rise in their monthly amount. Except for Arizona, a few states add an amount to the hiked payment.

Conversely, changes in Social Security Disability (SSD) are not generalized. Instead, SSD payments are based on a disabled person's family situation and work history. That said, an SSD recipient has, on average, experienced an increase of 76 dollars. This means the SSD payment has increased to 1,358 dollars per month in 2022 from 1,282 dollars in 2021.

On the other hand, the maximum value of Earned Income Tax Credit has increased by 207 dollars, meaning the 2021 amount of 6,728 dollars jumped to 6,935 dollars in 2022. Note that this tax benefit applies only to wage earners with low income. This tax perk is usually conserved for parents, although married couples without children can now also be eligible for the tax perk.

Families Staying With One or Multiple Disability

The new estate planning changes have positively impacted families with single or more disabled members. To add to an SSI increase of 841, families living with a disability have experienced a growth in their ABLE (Achieving a Better Life Experience) accounts. An ABLE account is helpful for any family living with single or multiple disabled individuals. Apart from a few exceptions, the yearly contribution has increased to 15,000 dollars in 2022.

New State Community Property Trust Statute

A Florida married couple (and a couple from any other state who marry under Florida statute) can now form a Florida State-sitused community property trust. Florida is among the separate property states for marital assets. When a spouse passes away, appreciated assets that the couple jointly owned in either TBE (tenancy by entirety) or other joint ownerships only gain stepped-up basis tax equivalent to the fair market value (FMV) for 50% of the assets attributable to the dead spouse’s interest.

On the contrary, under community property law, the same jointly-owned property gains a full FMV stepped-up basis tax at the demise of one spouse. Under community property law, all property a married party owns is considered the spouses’ community property or separate assets of one spouse. Additionally, property obtained during a marriage is automatically considered community property except if clear, convincing evidence exists that one spouse owns that property separately.

The Florida Community Property Trust Act permits married partners to treat as community property any property in a Florida State-sitused trust, as long as the trust satisfies particular statutory requirements.

Even though Florida and a few other states allow married partners to own assets as tenancy by the entirety, this type of ownership is vastly different from property classified as community. The primary difference between TBE as community assets and as separate assets in Florida is that TBE avails creditor protection advantages and survivorship rights, which are not necessarily provided by community property.

Regarding survivorship rights, when a spouse passes away, and TBE is in separate property states such as Florida, the property title passes immediately to the remaining spouse. Or, regarding community property, every property is entitled to devise or bequeath their 50% interest in the assets by a trust or will as they wish. For creditor protection, state law protects TBE assets from a lender of either partner, while with community assets, half might be subject to the lender of either spouse.

With the various creditor protection differences between community property and TBE testamentary disposition rights in consideration, the full FMV stepped-up basis tax at the demise of one spouse can be acquired for assets held in a Florida community property trust. This may be a valuable technique to avoid income tax under the proper circumstances. Consequently, married partners interested in creating a Florida community property trust must consult their tax advisor about the advantages and disadvantages of this estate planning technique.

The New Law Promotes Attractiveness of SLATs, Although with a Critical Warning

A form of trust called SLAT has recently been popular, whereas the estate, GST, and federal gift tax exemptions face the threat of reduction, like under the proposed federal tax law changes of 2021 and as is set to happen in 2026 when the exemptions are halved.

A SLAT enables one spouse (settlor spouse) to form a legal trust for their spouse’s (beneficiary spouse) benefit while enjoying the trust’s income and assets benefits via the beneficiary spouse's enjoyment of them. However, this arrangement has the critical additional feature of consuming the settlor spouse’s lifetime gift tax exemption before its reduction.

Florida recently passed a law enhancing SLATs’ attractiveness by protecting contingent reversionary interest in the legal trust for the settlor spouse from their lenders should the beneficiary spouse die first. This law is effective for legal trusts created after or on 1st July 2022. Several domestic tax haven states have their laws already incorporating this beneficial feature. However, after Florida passed this new law, married couples who want reversionary interest for the settlor spouse in a SLAT might not need to create and run their SLATs in other states already enjoying this law to acquire those suitable incomes.

Nevertheless, as is usually the case for tax laws, this technique may register various drawbacks. This is because it remains unclear whether the contingent reversionary interest of a settlor spouse in the new SLAT would be included in the estate of the settlor spouse when they die, defeating the goal of the estate, GST, and consuming tax exemption with the funding of the trust.

New Further Addition of State’s Rule Against (RAP) Perpetuities Period (RAP)

Florida also adopted a law to increase further the period a trust may exist, and it became effective on 1st July 2022. This period is called the RAP. It is an established feature of the trust law that was historically meant to forbid accumulated riches from indefinitely passing from one generation to the next in a given family and increasing in value down the road.

Until 2020, the state's established RAP duration was ninety years. This period was then increased to three hundred and sixty years for any trust established after 2000. The newly-established law increases the RAP duration to one thousand years for any trust established after or on 1st July 2022.

The Perspective of Estate Planning Changes of 2022

Any significant change has a small beginning, and experts in estate planning believe that most changes made in 2022 will realize an increase in the years to come. With the passing of the Build Back Better bill, more considerable changes will occur.

The estate tax exemption amount has not been reduced. Although, by 2025, the exemption will have been lowered to 6.5 million dollars. Again, all this is based on whether Congress becomes actively involved and acts accordingly. That is why experts believe there will be no significant changes for a while.

Additionally, no changes have been made to trust rules or capital gains for the last 21 years. Also, there is a zero increase in the tax calculation and income tax rates for married couples, singles, retirees, and wealthy individuals.

Find an Experienced Estate Planning Attorney Near Me

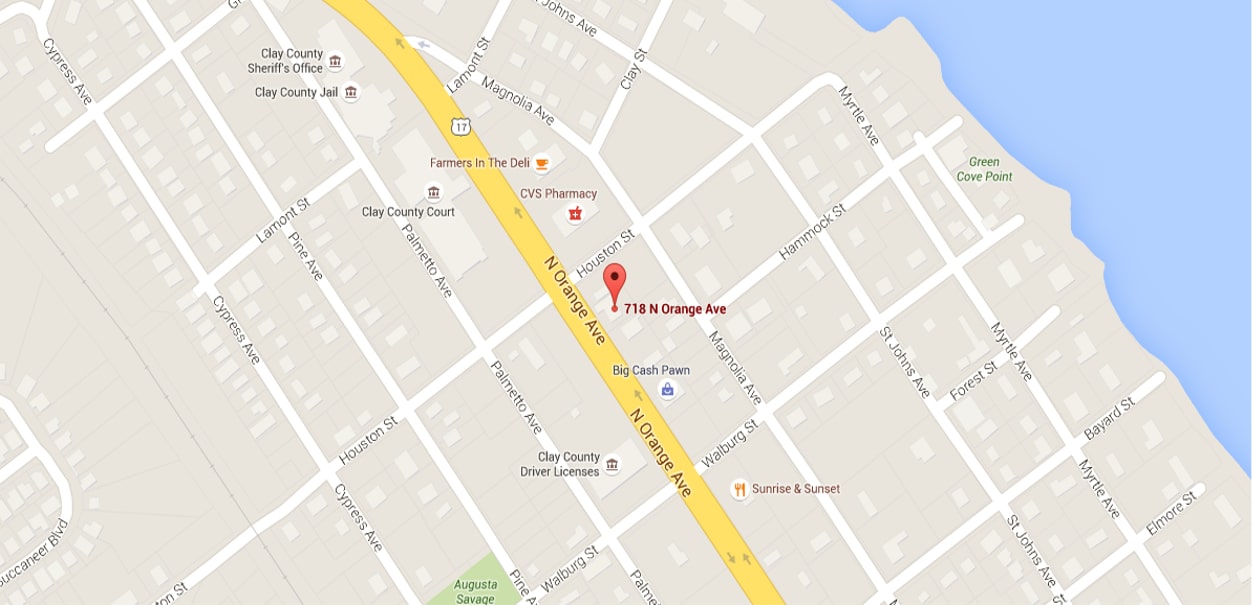

At Arnold Law, we want all our clients to be informed and empowered to make optimal decisions for their estates. That is why we will notify you of the critical changes in trust and state planning laws every year. If you have any questions or concerns regarding estate planning changes or need further clarification on something unclear, please do not hesitate to call us at 904-264-3627. We serve clients throughout Florida requiring probate and trust & estate law-related services.