A living trust is among Florida’s best ways of passing your property or money to your loved ones after you die. Often, people use this document as a substitute for a will because it provides robust protection. And since it’s one of the most critical documents as far as planning your estate is concerned, you have to ensure you draft it correctly. Also, it’s legally binding. One of the best ways to do this is to seek help from an experienced estate planning attorney.

At Arnold Law, we help clients throughout Florida State create the best living trusts for their estate planning. We’ll analyze your specific situation, listen to your goals, provide expert legal advice, and help you develop a comprehensive document that meets all your needs. In addition, we’ll assess your property base and advise you regarding estate tax and the proper titling of property.

Often, clients title their property in a manner that conflicts with their desires and trusts. Therefore, you want to look at the whole picture. And if creating a living trust isn’t in your best interest, we’ll give you honest advice about trying other ways. So call us today for quick, confidential services.

Defining a Living Trust

A living trust is also known as a revocable living trust or simply a revocable trust. It’s a trust you make while you are alive, as opposed to one that’s created after your death under the terms of your will. In Florida, trust creation is governed by Fla. Stat. § 736. A typical living trust has the following parts:

- Settlor, grantor, or trustmaker

- Successor trustee

- Beneficiaries

When you create a living trust, you’re called a grantor/trustmaker/settlor. As a grantor, you’ll name yourself the trustee. Then, after you’ve drafted your revocable trust, you’ll transfer all your properties into the name of your trust. This is called funding the living trust, and it’s the crucial step that permits your property to pass flawlessly to your loved ones once you die without going through probate court.

You’ll also have to name your beneficiaries. Beneficiaries refer to the persons you’re creating your living trust for. Generally, it could be your children, spouse, and grandchildren, just to mention a few. Put otherwise, beneficiaries of your trust are the persons you would like to inherit your property and money after you die. Additionally, you could specify the amount of cash or what property each beneficiary should receive and at what point to receive it.

Another most important party you’ll also have to name in your trust is your successor trustee. A successor trustee is an individual who will take charge of managing all the properties you placed in your trust should you die or become incapacitated. It’s also the individual who distributes your property to your beneficiaries after you die. The successor trustee plays a very critical role. For this reason, you should select a trustworthy and competent person. Often, people choose a friend or close relative. If it suits you, you could also opt for a corporate trustee who is an expert in administering trusts.

Once you die, the successor trustee privately distributes your property to your beneficiaries without going through the probate process. This significantly reduces the period it will take for your beneficiaries to receive the assets you left them. Additionally, it eliminates the attorney and court fees that are associated with the probate court.

You can modify or revoke a revocable living trust partly or entirely after it’s signed, something you can’t do with an irrevocable trust. You can change any section or clause of the living trust while still alive and are stable mentally. But once you pass away, the revocable trust becomes irrevocable. When this happens, the successor trustees and trust beneficiaries cannot change any of its provisions.

A revocable trust agreement isn’t a public document and can’t be filed with government bodies. Instead, it’s private, and only the parties involved are supposed to know about it. Additionally, a Florida trust doesn’t require its tax ID number when you’re still alive, and either you or your spouse acts as the first trustee. All tax losses and taxable income the trust assets generate flow seamlessly to you.

A revocable trust has to be executed properly and with the same formalities as a will. By this, it means you have to sign it before a notary and two witnesses. Florida State recognizes the authenticity of a revocable trust established in a different state provided it’s been properly established per the statutes of that other state. Thus, if you want to move to Florida, you don’t necessarily need to recreate your revocable trust for its provisions to be enforceable under Florida law.

Who Requires a Living Trust?

A revocable trust is among the most popular estate planning documents individuals create due to asset protection and flexibility. If any or all of these applies to you, a revocable trust is worth consideration:

- You’re a real estate owner

- You have children/grandchildren

- You have retirement plans, investment portfolios, or money in the bank

- You are married but don’t have a new estate plan in place or modified the preexisting one since you wedded

- You’re a business owner

- You have valuable family inheritances

- You are divorced but don’t have a new estate plan already in place or modified the preexisting one since you divorced.

How to Make a Revocable Trust

Creating a revocable trust involves the following steps:

Defining Your Goals

The very first and critical step towards estate planning is establishing your goals. This is because we have different estate planning documents designed to achieve various objectives. For instance, if avoiding probate is among your priorities, you’ll have to talk to a lawyer about creating a revocable trust rather than a will. And if avoiding the probate process is not crucial, a will can serve you. On the other hand, if you must plan for your incapacity, you should consider a revocable trust, a will, and powers of attorney.

As far as estate planning is concerned, there isn’t a one-size-fits-all document. Consequently, you should list all your estate planning goals then schedule a consultation with a skilled trust lawyer to discuss them. The lawyer will understand what you wish to achieve and then advise you on what documents are appropriate for your situation. If it’s a revocable living trust you want, you’ll need to decide whether to create a shared or individual trust.

Inventorying Your Assets

Once you’ve defined your goals, list all the property you want to protect and pass on to your family. To protect the property from probate, you’ll have to put them in the name of your trust (that is, funding your trust, as earlier mentioned). Inventorying your assets and having them readily available helps your living trust lawyer advise you in the best way possible regarding what you should add to your trust.

Gathering the Paperwork For Your Property

To fund your trust, you’ll have to gather all the ownership paperwork for your property. During funding, you’ll re-title the property into the name of your living trust. Finally, you have to ensure you properly place the assets into the trust; otherwise, they’ll have to be subjected to the probate process. Your lawyer can assist you with this process to ensure the trust operates as you intended.

Choosing Your Beneficiaries

Beneficiaries are critical to a living trust since the whole reason why trusts are created to benefit them. Your beneficiaries could be, among others, your children, spouse, or grandchildren. Before creating your revocable trust, you should know what individuals you want as beneficiaries and which assets you wish them to have.

Appointing Your Successor Trustee

As earlier explained, a successor trustee refers to the individual who’ll be in charge of distributing your property to your named beneficiaries per your wishes once you die. Their other duty is to manage the property on your trust should you become incapacitated before your demise.

Successor trusteeship is a challenging job that requires much attention to detail and work. Consequently, you should select a trustworthy and responsible person to manage these essential responsibilities. You also have to check with them before drafting your living trust to ensure they’re up to the task.

Consulting with Your Trust Lawyer

After you’ve listed your assets, gathered the ownership paperwork, chosen your beneficiaries, and appointed your successor trustee, you’ll want to set up a consultation with a skilled trust lawyer. It's worth repeating that a living trust is one of the most critical documents you’ll draft since it’s securing your lifetime accumulation of property.

Florida trust law is very intricate. Thus, you want to ensure your trust is legally binding and you’ve drafted it correctly. The ideal way to make sure you complete the document correctly is using a lawyer’s expertise. After creating your trust, the next step will be to sign it before a notary and two witnesses.

Managing Your Property with a Living Trust

Since you’re the trustmaker and trustee of your revocable trust, you can manage all the assets you put in that trust just as you did before it existed. You can sell, invest in, or spend on real estate. Technically, anything doable before creating a trust can be done after. As we mentioned, you can always revoke or modify your trust if you do not like how it’s set up. A revocable trust is highly flexible as far as managing your property is concerned while still enabling you to shield those properties from the probate court.

How a Living Trust and a Will Differ

Whereas a living trust and a will have several similarities, they do have considerable differences. A will is a document that permits you to transfer your property to your family and loved ones once you die. Particularly, a will enables you to:

- Appoint a trustworthy person to be your executor/personal representative to settle your estate in probate court and allocate your property to your family/loved ones once you die

- Appoint a legal guardian for any child under 18 years

- Name the individuals who ought to receive your property after you pass way

With a will, once you pass away, it’ll have to be taken through the probate process before your property is distributed to the people you named. This is among the most significant differences between a living trust and will.

It’s your personal representative’s responsibility to probate your will. The representative must also ensure your property is distributed per your wishes and settling all your debts. Generally, transferring assets takes a lengthier period with a will than a revocable trust since a trust does not have to be taken through probate. Avoiding probate is the primary reason why most people opt for a revocable living trust rather than a will.

If you pass away and have no will, your assets will be subjected to the Florida intestacy laws. Consequently, your property will have to be distributed per the state’s law without your input. This could be unideal, particularly if you have family members you do not want to give your property to. Therefore, it is an excellent idea to draw up a will. However, if you need to avoid probate so much, you should go for a revocable living trust. A revocable trust has several benefits over a will.

However, generally, a living trust can’t entirely replace the need for a will. There are some properties you may not wish to put in a living trust, and a will provides a backup plan for these kinds of property. For instance, it could be impractical to place tangible personal assets like furniture, jewelry, and automobiles in a trust.

As a result, some of your properties will remain outside your trust, making a will necessary to name the beneficiaries you intend to leave those specific assets. Also, if you purchase or acquire new assets and do not add them to your living trust before you pass away, the assets will not pass under the trust terms. You could use a will to name beneficiaries to inherit assets that you have not left to a specific entity or person in your revocable trust.

Advantages of a Living Trust

A living trust comes with five primary advantages that will help you accomplish your estate planning objectives. They include:

It Helps You Skip the Probate Process and Maintain Privacy

A revocable trust helps you to pass your property to your beneficiaries in the most effective way. This is because it avoids the lengthy, expensive, and stressful probate process. Probate may delay your beneficiaries from acquiring your property for several months and even years. It can also be hard to endure the probate court process during the mourning period.

We mentioned that probate court avoidance is the primary reason most people opt for a revocable living trust over a will. This is because a will must go through the probate process before your property is transferred to your beneficiaries. Because probate is a public process, the will’s contents are also public, increasing the chances of people contesting it in court. This could further delay your loved ones from receiving your property.

Because a revocable trust doesn’t go through probate, transferring your property to your loved ones is a private affair, and only those named by the trust are entitled to know the kinds of property it contains. Furthermore, transferring assets is highly efficient and could occur within days or a few weeks rather than several months or even years.

It Helps You Control Your Assets and Finances After You Die

A living trust helps you control your property and money after you die, so you can rest assured that your loved ones are protected and financially stable. As we mention, when creating your living trust, you’ll appoint a responsible person to be the successor trustee. This person will manage all your assets and money and allocate them to the beneficiaries per your wish. This enables you to make sure your beneficiaries receive your money and property fast enough so they can pay for essential expenses like medical expenses, mortgage payments, outstanding debts, and funeral expenses.

Also, a living trust allows you to specify who you wish to leave what property or how much money a given beneficiary ought to receive. This enables you to ensure your money and property go to your beneficiaries while leaving out the persons you’d never want to give your assets.

It Helps in Ensuring Your Children are Well-Protected After You Die

A living trust helps you ensure your children are well cared for financially and emotionally after you die. Since you can control your assets with a revocable trust, you can ensure that your children achieve a specific milestone such as graduating from university or reach a mature enough age before receiving their inheritance. You can also protect your money and children should they have any problems in the future with creditors, spouses, gambling, alcohol, drugs, or managing money.

Generally, a revocable trust is a more robust document that gives you, your loved ones, and your property more protection compared to a will.

It’s Helpful in Planning for Incapacity

Creating a revocable trust helps you to protect your assets and loved ones by choosing a trustworthy person to be in charge of your assets should you, for any reason, become incapacitated, unable to communicate. Whenever people talk about estate planning, they often only think about planning for after they die. But detailed estate planning also has to cover planning for when a person becomes incapacitated. This is because it’s not uncommon for a person to be incapacitated and incapable of communicating at a given point before their demise.

Without a revocable living trust, your loved ones will require guardianship to be able to access your property should you become incapacitated. But with a living trust, the successor trustee steps in and manages your property for you. When you’re planning for your incapacity, you want to accompany your trust with a will and both medical and financial powers of attorney. These ensure that your medical and financial decisions will be well taken care of should you become mentally incompetent.

It Helps Preserve Your Legacy and Wealth for Your Future Generation

Based on your family’s estate size, you can create a revocable living trust, which helps you avoid estate taxes. Also, you can make sure the priceless inheritance remains within your family to preserve and uphold your family’s legacy.

Asset Protection for Revocable Living Trusts

Most people believe revocable trusts provide asset protection for them. This isn’t true. A revocable trust doesn’t protect the property in it from your creditors. A revocable trust is a self-settled trust, meaning the grantor is also the trust beneficiary. Florida statute unequivocally requires that a revocable trust you create for your own benefit isn’t protected from your or your beneficiaries’ creditors.

You can create a revocable living trust to provide substantial asset protection benefits for future beneficiaries, such as your children. If the trust requires that after your demise, the remaining assets be held within the trust or in separate sub-trusts for your beneficiaries’ benefit, the money can be protected from these beneficiaries’ creditors.

Most married couples jointly own their principal assets as tenants by the entirety. Tenants, by the entirety, protect your assets against your spouse’s debts. Your spouse might lose the entirety of property protection if they transfer property without planning carefully. For example, if you and your spouse make two separate revocable living trusts, the entire property given to either of your beneficiaries loses tenants by the entirety protection.

Find an Experienced Living Trust Attorney Near Me

For most people, and most definitely for you, nothing beats family and loved ones. You’ll always want to see them well taken care of, even in your absence. And at Arnold Law, nothing is more important to us than helping you achieve the desire of protecting them. Through comprehensive estate planning, you and your loved ones can have peace of mind. A living trust is instrumental in achieving this goal.

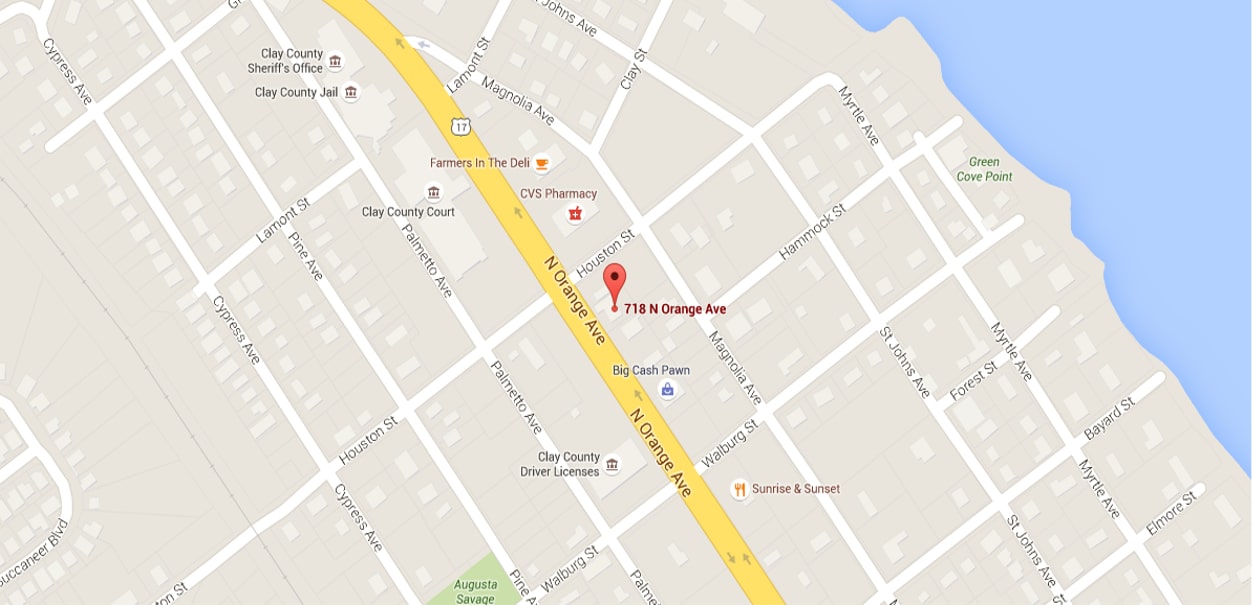

We boast the insight, skill, and experience of establishing living trust agreements that’ll best suit your objectives as part of an estate planning strategy. Should you have any questions about living trusts, including concerns on how we can help you create one, call us at 904-264-3627 to schedule a free consultation. Regardless of where you are in Florida, we’ll help you create a document that conforms to state laws and satisfies all your needs.