Seniors are vulnerable members of society prone to abuse and exploitation. Through the guardianship process, you can protect the best interests of an elderly loved one that can no longer take care of themselves because of mental incapacity or physical ailments. Florida elder laws also allow planning for aging where you can be sure of enjoying your golden years knowing your legacy is well protected. At Arnold Law, we understand elder law can be incredibly complex, not to mention that once-vibrant and active loved ones can insist on clinging to their independence. We can help by ensuring they understand elder guardianship and the process's numerous protections and perks.

The new elder law enacted on July 1, 2020, offers more protection by requiring greater oversight of court-appointed guardians. Under the law, more reporting requirements exist, and guardians need court approval to sign "Do Not Resuscitate Orders." Also, the statute disqualifies guardian petitions from persons unrelated to the allegedly incapacitated person. Let us use our insight, knowledge, and experience to help you understand the law and how it protects incapacitated seniors.

Florida Guardianship Statute Explained

Under Chapter 744 Florida statutes, guardianship is a legal proceeding where the court appoints a guardian to exercise the legal rights of an incapacitated individual. The guardian acts as the ward's primary decision-maker per the rules and guidelines outlined in the Florida guardianship statute and the court order.

The guardian legally owes the ward a duty of care. When making decisions, the guardian must prioritize the ward's best interests and remain under the court's keen supervision. Some of the decisions a guardian can make on behalf of the ward are dictating where they will like, how they will maintain good health and hygiene, and how they will manage their finances, welfare, and social lives. Guardians also have the authority to make medical decisions on behalf of the ward.

There are different types of guardians. Sometimes, the court can appoint one person to be in charge of the personal affairs of a ward and another to manage financial assets. However, a "custodian" is the legal name given to the person in charge of the financial assets of an incapacitated individual.

Guardianship cases are mentally and emotionally stressful for those involved. A long list of legal ramifications can tag along with the decision to file for the guardianship of an incapacitated loved one. Having a skilled attorney in your corner can make the difference between having your guardianship petition approved and losing the case.

It is possible to save your loved ones from the guardianship process with proper planning for old age and potential incapacitation. You can dodge the guardianship process through a comprehensive estate plan by appointing someone of your choosing. Competent probate and estate attorneys can also help you consider alternatives, like a durable power of attorney and selecting a healthcare surrogate. However, these options are merely available before incapacitation.

Who Qualifies to Serve as a Guardian?

If a ward had named a preneed guardian before being declared incapacitated, the court would appoint that person as long as they qualify for the position and a conflict of interests does not exist. This only happens when the ward has made a written and verifiable declaration naming the person in question as the preneed guardian.

If your loved one is incapacitated and has not named a preneed guardian, it is crucial to know whether you qualify to take over their affairs legally. Florida laws under statute 744.309 regulate who is eligible for the position. After the new law became effective on July 1, 2020, a judge cannot appoint a ward's guardian unless they are related by blood, adoption, marriage, or have maintained close relations without a wage or other forms of compensation.

Other qualifying requirements include:

- You must be at least 18 years and a Florida resident.

- Must be a lineal relative or related to the ward through adoption or blood. You can also be a guardian if you are the spouse of someone who qualifies as the ward's guardian.

- You must not be a convicted felon, a person convicted of the abuse, neglect, or abandonment of a minor

- You must be of sound mind and physical health, allowing you to perform your guardianship duties.

- If you are a non-resident, you must be closely related to the ward and able to perform your roles adequately.

Banks & Trust Companies as Guardians

Institutions like a Trust Company, savings association, or loan association can qualify as nonprofit or for-profit corporate guardians. However, the law only allows these institutions to be guardians of a ward's property. The arrangement works well, especially for individuals with significant assets or investments that require management by a professional.

Whether you are an individual or an institution seeking to be the guardian of someone you believe can no longer handle their finances and personal affairs, it is crucial to seek legal representation. Your lawyer will serve as the "attorney of record." Once appointed, the expert will also guide and help you perform your duties and help answer any legal questions you have.

The Permanence of a Guardian's Position

If the court appoints you as a guardian, you must furnish a bond and complete a court-approved course for the guardianship position. The law requires you to provide annual reports that the court clerk will review and present in court for approval. If the court notices a conflict of interest or an inability to perform your duties, it can remove you as a ward's guardian. You can also resign from the position by providing adequate notice to the court.

Generally, the guardianship position can be temporary. For instance, you will no longer need to be a guardian if a ward recovers from an incapacitating ailment. If the court re-examines the ward and declares them fit to run their health and wealth affairs, you can file a petition to reinstate the ward's rights.

Duty of a Guardian

The law allows different types of guardianship based on a ward's needs. While the most common type is designed for seniors with dementia and other mentally incapacitating conditions, some adults only have trouble managing their large estates.

Therefore, the court only grants financial guardianship to help manage complex financial affairs while the ward addresses personal physical and medical needs. The court-appointed guardian acts in the ward's best interests, although the duties that come with the role depend on the type of guardianship awarded.

Depending on the situation, a ward can request a guardian appointed to help manage personal and medical needs or assets and finances. Voluntary guardianship is less restrictive because a ward can choose their guardian and set limits on a guardian's authority. They will still enjoy the court's protection, and the chosen guardian must act in ways that benefit the ward and their estate.

On the other hand, the court will appoint an involuntary guardian if you fall ill or become incapacitated because of your age or mental state. There is also the option of selecting an emergency or temporary guardian during sudden incapacitation. The temporary guardian acts for a short period awaiting the appointment of a permanent guardian.

Irrespective of the type of guardianship, the law allows a ward to remain under a guardian only when incapacitated. Even seniors can have their rights restored once they regain their decision-making capacity.

Guardian of the Person

If you are the court-appointed guardian of the person, the law requires you to meet the annual reporting requirements. You will also be responsible for making decisions related to the ward's welfare, which may include deciding on matters of healthcare, accommodation, and socialization. The court expects you to create and implement a plan that meets the ward's medical, psychological, social, and personal needs.

Guardian of the Property

A guardian of the property manages a ward's assets and makes financial or legal decisions regarding complex financial matters. This could include the ward's real estate properties, bank accounts, and investment accounts.

You have to protect and manage a ward's financial assets. The court expects you to file an initial report that shows the ward's inventory of assets and how you plan to protect and manage them. You must also file an annual report showing how you have implemented your plans and the complete and accurate account of any transactions regarding a ward's assets.

Guardian of the Person and Property

The judge will appoint a plenary guardian if the ward cannot manage personal and financial affairs. The guardian has the authority to make decisions that work in the ward's best interest concerning their well-being and assets.

A guardian of the person and property has numerous duties not limited to entering contracts on behalf of the ward, filing personal or business-related lawsuits, managing or selling property, and applying for government benefits. Because of the restrictiveness of this type of guardianship and the power awarded to the plenary guardian, strict laws are in place to protect vulnerable seniors from abuse or extortion.

Understanding How the Court Determines Someone Is Incapacitated

Under Florida Statute Section 744.102, an incapacitated individual is a person legally determined to lack the capacity to manage their property or essential personal health and safety requirements. Before the court can appoint a guardian, the ward must be incapacitated.

If you suspect a loved one is incapacitated, you can file a "Petition to determine incapacity." This allows the court to determine whether the loved one is indeed incapacitated. The court will appoint an examining committee of three members to help confirm whether the information on your petition is factual or if you have misplaced beliefs about a loved one's incapacitation.

One of the examining committee members must be a psychiatrist. The other two can be gerontologists, psychiatrists, physicians, psychologists, licensed social workers, advanced practice registered nurses, or persons whose professions equip them with the training, skills, knowledge, or experience to provide the court with expert opinions. One of the committee members must have an unparalleled understanding of the specific type of incapacity mentioned in the petition.

The examining committee will review the medical records of the alleged ward and file a report explaining what they have concluded and how they arrived at their decision. Generally, the committee members will consider whether the apparent incapacitated individual can make and exercise informed choices when:

- Signing contracts

- Voting

- Managing assets/property and when issuing gifts

- Choosing their preferred residence

- Selecting a partner to marry

The above list is not exhaustive, and it is common for the committee members to consider other relevant factors like an alleged ward's ability to have a driver's license and operate a car. Typically, the experts will consider factors relevant to a case based on the ward's alleged cause of incapacitation. Incapacitation examinations include functional, mental, and physical health assessments that enable the committee members to make reports from a well-informed perspective.

The court allows the alleged incapacitated individual to hire their attorney or have one appointed by the court. This ensures fair proceedings and increases the chances of the court dismissing the petition if loopholes or lack of good faith exist. The alleged ward's attorney can table evidence disproving their client's incapacity.

Each of the committee members has a right to their opinion. If at least two conclude the alleged ward is not incapacitated, the court will dismiss the petition to determine incapacitation. If at least two of the examining committee members conclude the alleged ward lacks the capacity to exercise certain rights, the court will schedule a subsequent hearing to establish whether that person is partially or totally incapacitated. The idea is to determine the areas where guardianship can be beneficial. The court can appoint a guardian for the person, for property only, or a guardian for the person and property.

If you are considering becoming the guardian of an ailing loved one, it is crucial to seek the expertise of a knowledgeable guardianship attorney. Receiving skilled help when filing the petition and legal aid to understand your situation can make all the difference in the outcome.

Guardianship vs. Guardianship Alternatives

Guardianship is a complicated process. The initial stages will take about four months to complete. The exact timeframe will depend on whether your guardianship petition is contested and whether the ward needs limited or plenary guardianship.

While a guardian has a duty of care to the ward, guardianships are restrictive. The ward can lose substantial rights to make their own life choices once declared incapacitated. Fortunately, other less-restrictive options allow a ward to remain in charge of their affairs, even after incapacitation.

It is best to consider guardianship only as a last resort or when other alternatives cannot safely meet the ward's needs. Establishing guardianship is expensive and time intensive, and the only way to benefit from other options is to take action before the onset of incapacity. Generally, the alternatives to guardianship are advance directives that convey an individual's wishes in case of future incapacitation.

Here are other alternatives to guardianship:

Living Will

A living will that expresses your wishes and gives directives you deem suitable in case you cannot make decisions in the future. The legal document can offer instructions on what should happen in case of a terminal illness, incapacitation, or death.

Health Care Surrogate

A healthcare surrogate allows a specified person to receive your health information and make healthcare decisions on your behalf. The legal document proves that you trust the person in question to make the best decisions on your behalf if you cannot do so because of your mental or physical state. The role of a health care surrogate kick in immediately after the ward is declared incapacitated.

You can choose your healthcare surrogate in advance and make your wishes known in a written legal document. To make the document legally binding, you should sign in before at least two witnesses. The process is much more straightforward with the help of an attorney.

Power of Attorney

With a power of attorney, you (the principal) give another person (the agent) the authority to act on your behalf during specific situations. For instance, you can authorize the principal to deposit funds into your bank accounts or even deposit checks in the event of incapacitation.

For a power of attorney to be perceived as a legal, binding document, it must be signed before at least two witnesses and a notary public. A power of attorney can be revoked if the principal becomes incapacitated. However, it can continue through a Durable Power of Attorney, where the principal categorically allows the agent to carry on with specified duties.

Durable Power of Attorney

A Durable Power of Attorney is a type of Power of Attorney that remains effective even if the principal becomes incapacitated. The legal document allows the principle to give an agent the authority to make their financial and healthcare decisions before and in the event of incapacitation.

Signs an Elderly Loved One Needs Guardianship

If your parent or relative needs help with maintaining personal hygiene, cooking meals, paying bills, and making hospital visits, they can likely benefit from guardianship. Unfortunately, taking care of a loved one has limits, especially from a legal perspective. Sometimes, it is crucial to seek proper authority to ensure you can do more for your ailing parent.

The decision to take legal control of a loved one's affairs can be daunting, especially if other family members contest the choice. However, putting off guardianship can only make matters worse once the incapacitated loved one hits a health or financial crisis.

Here are a few pointers that show a loved one requires legal guardianship as soon as possible:

Lack of Pre-Planning

If your parents had appointed a voluntary guardian or a healthcare surrogate, they likely do not need a guardian. The same is true if a loved one gives someone else authority over their affairs through a power of attorney or durable power of attorney. If they took other steps toward proper estate planning, it is possible to avoid guardianship once they lose the capacity to manage their affairs.

On the other hand, guardianship is necessary if there are no plans showing the wishes of an ailing loved one or giving directives on what to do about their personal, health, and financial affairs. The process can help protect the best interests of your incapacitated loved one and ensure they are safe from maltreatment and extortion.

Health and Well-Being

Guardianship is only necessary when a loved one is incapacitated. You can also seek person or property guardianship if a ward cannot manage specific affairs effectively. If a loved one's health is in jeopardy and family squabbles do not allow smooth decision-making through the health care proxy, it is crucial to seek the aid of a guardianship attorney immediately.

Safety

Conditions like cancer, dementia, or organ failure are delicate. If a loved one cannot make correct healthcare decisions, their mental and physical health can deteriorate faster. Guardianship can help give your loved one a good chance of fighting a potentially deadly ailment. Sometimes, it is safer for someone else to make decisions on behalf of an ailing parent.

Also, the elderly are soft targets for scammers and relatives looking to exploit their vulnerability. If you have noticed suspicious transactions from bank accounts and unreasonable "gifts" issued to others, it is best to talk to an attorney about the guardianship process.

Find a Guardianship Attorney Near Me

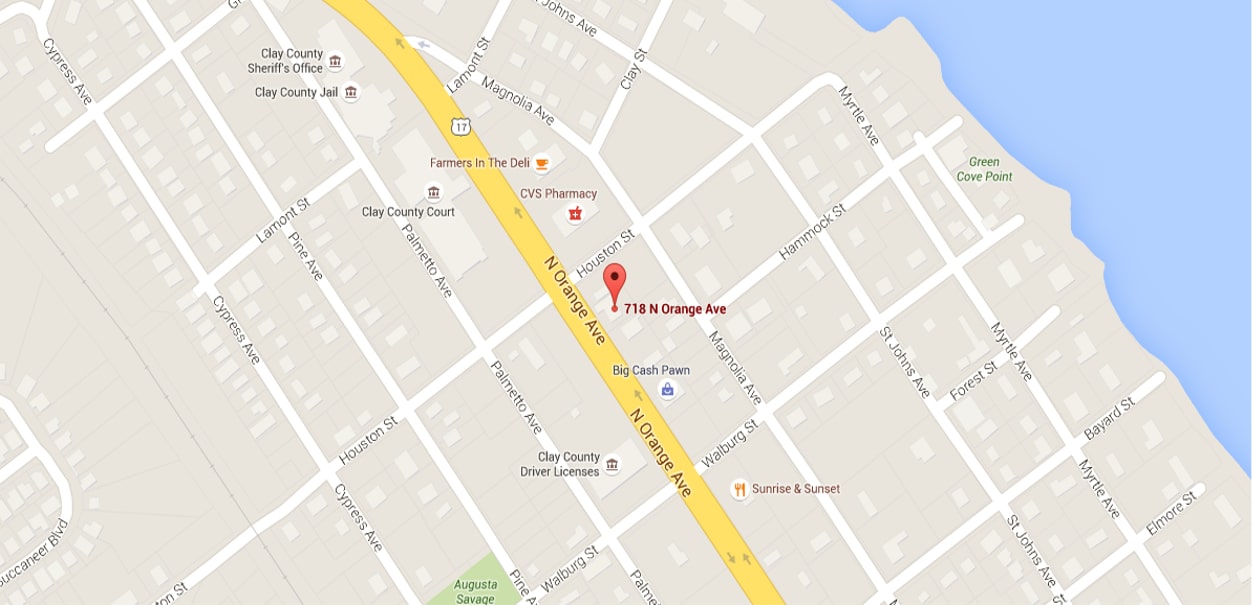

Elder law and guardianship are complex, making it daunting to know the best way to protect an incapacitated loved one. At Arnold law, we have a compassionate team of attorneys that can help you navigate guardianship, estate planning, and the probate process in Florida. We have the expertise to cover all your legal needs and can help you protect your best interests as you age. If you want to be appointed guardian, we will help you file a petition and provide reliable guidance to ensure you fulfill your roles. For expert assistance or to speak to a skilled guardianship attorney, please call us at 904-264-3627.